The News

Africa’s next generation of major infrastructure projects will need banks and investors to prioritize partnerships in order to raise the funding required, a top banking executive told Semafor.

The era of individual banks underwriting large projects — from transport corridors to energy and mining — is effectively over, said Charles Russon, Absa’s head for Africa regions. Global volatility, tighter capital rules, and the sheer scale of Africa’s development needs have been stretching traditional risk appetites.

Russon explained that major deals are increasingly being structured through models that bring together commercial banks, development finance institutions, concessional lenders, and long-term investors such as pension funds. He said the “blended finance” approach, where each institution takes a defined slice of risk, has become unavoidable over the past 18 months as Africa faces a tougher global financing backdrop.

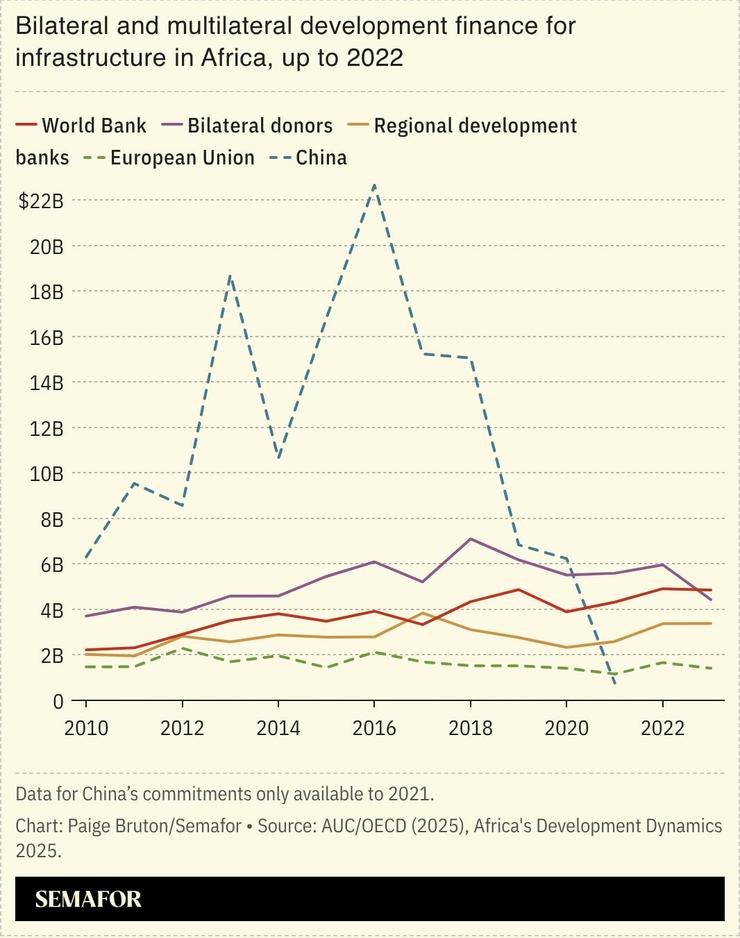

Development flows from traditional Western partners are tightening, while geopolitical tensions are disrupting trade, forcing governments and companies to rethink who they rely on. The continent has an annual infrastructure funding deficit of about $130 billion to $170 billion, the African Development Bank estimated last year.

Know More

Despite the headwinds to growth, Absa — South Africa’s third largest bank by assets, with operations in 10 African countries — expects African GDP growth of around 4% to 4.5% in the coming year. Russon said East Africa stands out as a bright spot, despite recent news of difficult elections and protests in Tanzania and Uganda. “It’s growing at over 5% with major energy and infrastructure activity,” he said. “Whatever the political noise, there is a great deal happening there, and we see [the subregion] as a massive opportunity.”

As countries and corporations look to diversify supply chains and trade relationships, Africa’s combination of natural resources and population growth is drawing renewed interest. But capital, Russon warned, will only move if barriers are lowered and cross-border business is made easier — including by turning the African Continental Free Trade Area’s potential into reality.