Donald Trump’s call for credit card companies to cap interest rates at 10% weighed on markets and sparked pushback from major lenders.

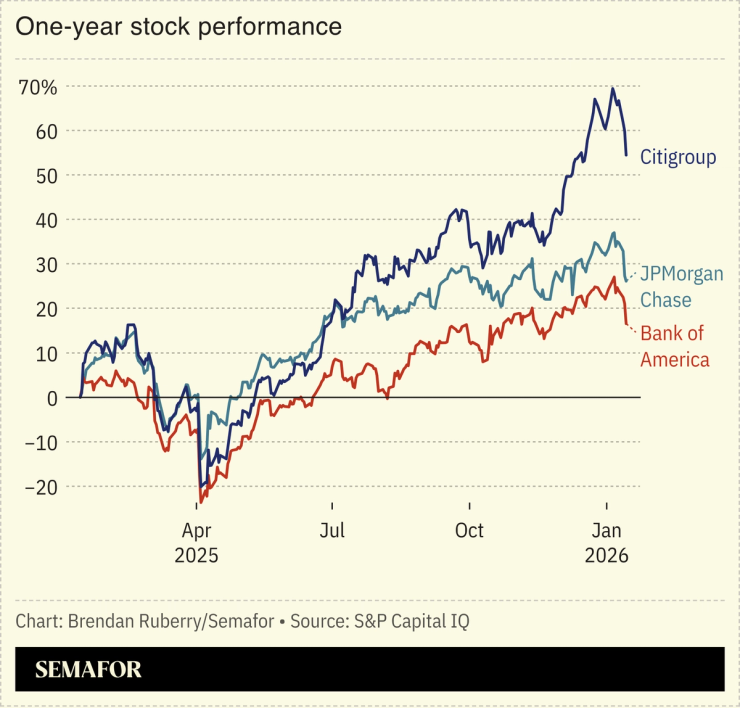

The US president’s populist push — which comes as banks reported mixed earnings Wednesday — threatens a blistering stock rally, as investors eye possible threats instead of celebrating the prospect of limitless gains.

Nobody in banking thinks it’s going to be beer and skittles forever,” one finance attorney said.

“It’s a messy intersection of politics and banking policy.” Citigroup’s CFO warned of a “deleterious impact on the economy,” while Bank of America’s CEO cautioned over “unintended consequences.”

At least one firm is heeding Trump’s call: Bilt, known for offering rewards on rent payments, unveiled new cards with a 10% interest rate cap.