The Scoop

The rollback of renewable energy policies in the US under the Trump administration “is not good for business,” the CEO of Masdar said in an interview, but with billions to invest and a willingness to be patient for returns, the Abu Dhabi renewable energy giant is looking to pick up struggling wind and solar assets in the world’s largest economy.

“I am not a big fan of anyone who comes in and [makes a] retroactive change, because when I made my investment, I made my investment based on a certain set of criteria, certain sets of rules and policy,” Mohamed Jameel Al Ramahi told Semafor. “This electron is the backbone of any economy. That is not going to change, and that business that we built is not designed to be built and expire in one year.”

Still, “we love the US,” Al Ramahi said, and Masdar “wants to deploy more capital there.”

Masdar — which owns a 50% stake in California renewables developer and operator TerraGen — would consider buying assets “on the East Coast” that are struggling as a result of recent subsidy cuts, as a “complement” to TerraGen’s high concentration of wind and solar power in the West, Al Ramahi said.

Know More

Abu Dhabi’s pursuit of renewable energy at home and abroad is based on a conviction that electrification is growing at breakneck speed, driven in part by the proliferation of data centers, but also rising urbanization.

Masdar’s interest in upping its renewables exposure in the US comes as the 20-year-old firm is midway through a rapid international expansion, with plans to invest up to $35 billion in equity and project financing over the next four years. The spending spree builds on $45 billion it has already deployed to help it reach a target of 100 gigawatts of renewable energy capacity in its portfolio by 2030, a goal set in 2022 when Abu Dhabi’s oil and gas firm ADNOC, sovereign wealth fund Mubadala, and utility TAQA became Masdar’s three shareholders.

Masdar is about two-thirds of the way there: It has 45 gigawatts of renewables capacity in operation or committed, and 20 more in the pipeline.

To reach the final third, Masdar is looking to expand in its existing markets, Al Ramahi said, including the Gulf, Africa — where it is one of the largest international developers of renewables through its company Infinity Power — Europe, and the US.

Its existing footprint is vast: At home, Masdar and EWEC, a UAE utility, broke ground last year on the world’s first large round-the-clock renewable energy project, combining a solar plant with a battery energy storage system.

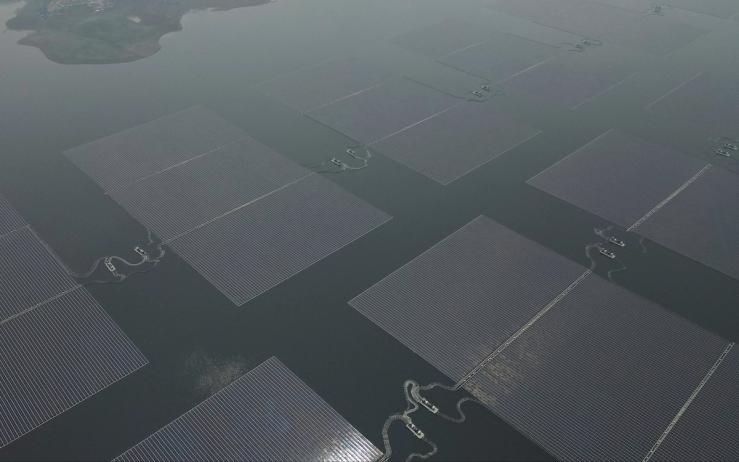

In Europe, Masdar has been a massive investor in offshore wind in the UK and Germany, and in Asia it has agreements for a floating solar project in Malaysia and a battery storage system in Uzbekistan.

Batteries, and the ability to dispatch renewable energy 24/7 from storage, is an area of growth for the company, particularly in Europe, according to Al Ramahi.