The News

An executive at the largest owner of single-family rental homes in the US said President Donald Trump’s move to outlaw institutional investors from owning homes won’t actually address a homebuilding shortage.

“The notion that we are crowding out the individual homebuyer, I think, is an old view,” Stephen Scherr, co-president of investment firm Pretium, said in an interview.

Trump’s announcement that he hopes to ban institutional investors from owning single-family homes is the president’s latest acknowledgment of an affordability gap he’s previously shrugged off or blamed on Democrats. His administration is also buying housing bonds and floated the idea of a 50-year mortgage in an effort to bring down the cost of homeownership.

“A third of Americans are renters, either by choice or because they belong to the roughly half of Americans who wouldn’t qualify for a mortgage,” Scherr, a former Goldman Sachs CFO, said. That figure is about 90% for Pretium’s renters, who otherwise look like the population at large — mostly millennials and Gen X, roughly 40% married, and with incomes actually a fair bit higher than the average.

In this article:

Know More

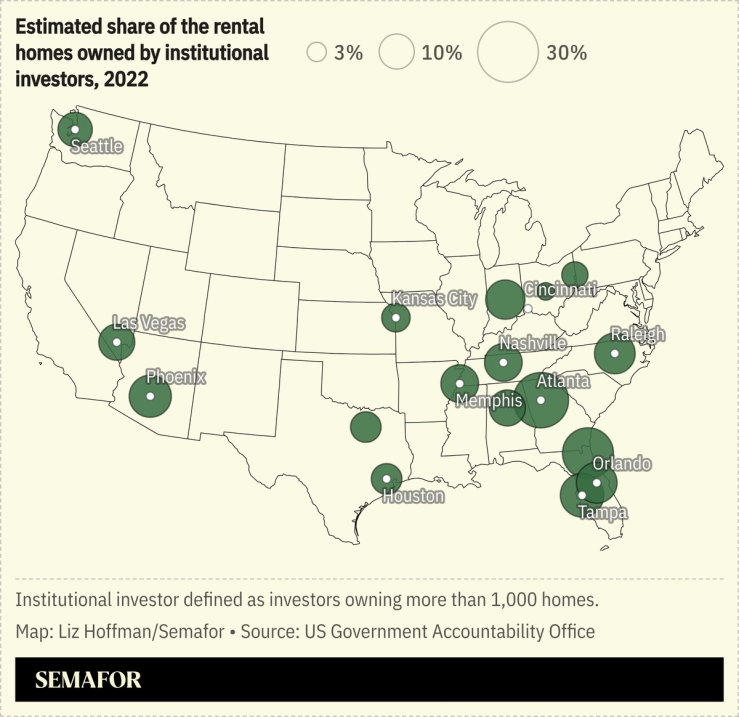

Corporate landlords and investment firms own less than 5% of the nation’s 87 million homes, according to BatchData, though that fraction is growing and obscures bigger footholds in local markets. Investment firms own one in four homes in Atlanta, one in five in Jacksonville, Fla., and one in six in Phoenix, according to a 2024 report from the federal Government Accountability Office.

Critics say appetite from firms like Pretium, Blackstone, and others has driven up prices and pushed homebuilders to build to Wall Street specs, rather than increasing the number of disappearing starter homes.

Pretium buys a “de minimis” number of homes one-by-one on the open market, Scherr said. Instead it buys most of its homes in bulk from homebuilders, which helps defray the risk of new developments and lets companies like Lennar and Toll Brothers invest more quickly in new projects.

The US has a shortage of between 4 million and 5 million homes.

Liz’s view

The industry is still outrunning its early days, when investors like Blackstone went on buying sprees after the foreclosure crisis. These investors also torched goodwill by aggressively fighting their property tax bills, drowning small-town officials in paperwork and, according to one study, shifting $4.1 billion from local government coffers to Wall Street investors.

But the industry looks different today. It’s a source of financing for homebuilders whose traditional lenders, regional banks, have pulled back from construction loans. As an always-there buyer, they play a similar role for housing as big tech companies do for data centers or electric grids do for power stations.

The US does have a housing shortage, but rental-home investment funds arguably enable at least as much excess housing to be built as they take off the market. Their footprint is biggest in some of the most affordable regions in the US. And local zoning restrictions, title insurance, and the increasing cost of homeowners’ insurance are all bigger problems.

The Trump administration is doing the industry a favor here. Anger at corporate landlords has bubbled in state legislatures, most recently California. A national solution that involves rent-to-own programs (with real paths to ownership, not the predatory failure locks of the past) and brings in Wall Street firms, a big regional bank or two, and the federal government’s mortgage guarantors, Fannie Mae and Freddie Mac, could make a meaningful difference. “Private capital” is still a mystery to most people outside Manhattan, and the White House is serving up an opportunity they’d be smart to seize.

“Anything we can do as an industry to work with homebuilders, banks, and the government to accelerate people’s path into home ownership, we’re game to play,” Scherr told me.

Room for Disagreement

“It’s a David versus Goliath match where Goliath has better algorithms and deeper pockets,” Brian Hamilton, founder of fintech company Sageworks, wrote for The Hill in support of Trump’s ban. “I have wondered over the past several years how we have seen almost a fivefold increase in interest rates and a global pandemic without an adverse downward effect on real estate prices or even the economy.”

Notable

- “Adding ‘corporate investment in rental housing is good’ and ‘buybacks are an important financial tool’ to my IN THIS HOUSE, WE BELIEVE yard sign,” The Economist’s Mike Bird wrote recently.