President Donald Trump’s newest proposals to tackle Americans’ anxiety about the cost of living are already proving difficult to enact.

The president last week announced a pair of economic policies — banning institutional investors from buying single-family homes and capping credit card interest rates at 10% — that track closer to the GOP’s populist fringe than to its free-market core.

But it’s highly likely that both will require Congress to pass legislation; that’s shaping up to be a heavy lift for both chambers, especially as private-sector heavyweights like Wall Street line up in opposition.

“We were blindsided by it,” Rep. Ann Wagner, the Missouri Republican who chairs the House Financial Services Committee’s capital markets panel, said of the housing proposal.

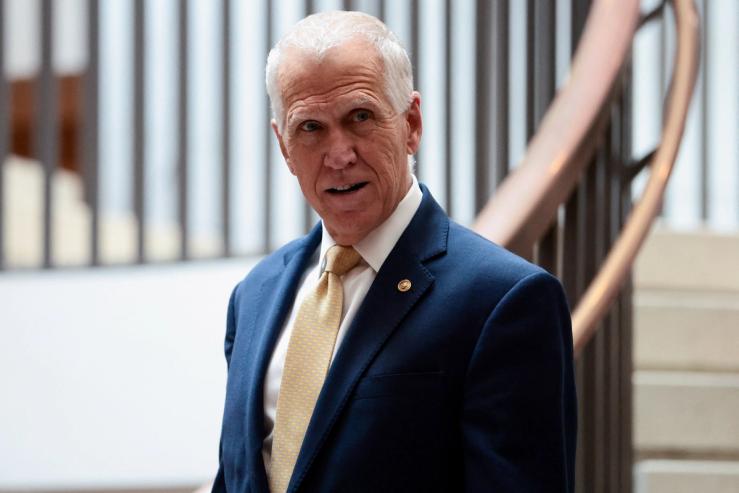

Sen. Thom Tillis, R-N.C., went further: “No,” he said when asked if it was a good idea.

“Everybody who makes [up] a lot of the various businesses getting in the acquisition of homes, it still represents a minority of the housing market today,” Tillis added. “If they reached a point to where we thought that they had acquired so many that they could actually influence the market, then maybe. We’re not.”

Sen. Josh Hawley, R-Mo., has expressed support for both Trump ideas, but he signaled they would likely require Congress to act. He wrote on X he “can’t wait to vote” for the credit card proposal and said in an interview he expects legislation to enact the housing one — as well as a related idea to allow Americans to tap their retirement savings for down payments.

“Can the president do the institutional investor thing entirely by executive order? ... Maybe, but we should put it into law,” Hawley said. “And I think the 401(k) [part], we’d have to pass that, because that would require a change of the tax law.”

Meanwhile, the finance sector is moving quickly to fan Republican resistance. Private equity firms have leapt to the defense of their housing investments, highlighting how they rent out many of the homes and that the properties make up a fraction of the nation’s houses. And banking groups released a joint statement within hours on Friday that argued that a cap on interest rates would restrict Americans’ access to credit.

“To be blunt about it, most Democratic senators have been afraid to take this stand because of the powerful entities” who are against it, said Sen. Jeff Merkley, an Oregon Democrat who’s drafted legislation that would make it harder for hedge funds to buy single-family homes.

“Hopefully we’ll have a bipartisan bill,” Merkley added. “I don’t know if that’s possible. I don’t know, because every bit of cooperation across the aisle takes a lot of effort, but we’re going to try to achieve that.”