Kenya licensed 42 new digital lenders, raising the country’s total number to 195, as the central bank pushes to formalize a sector that has become an important part of East Africa’s largest economy.

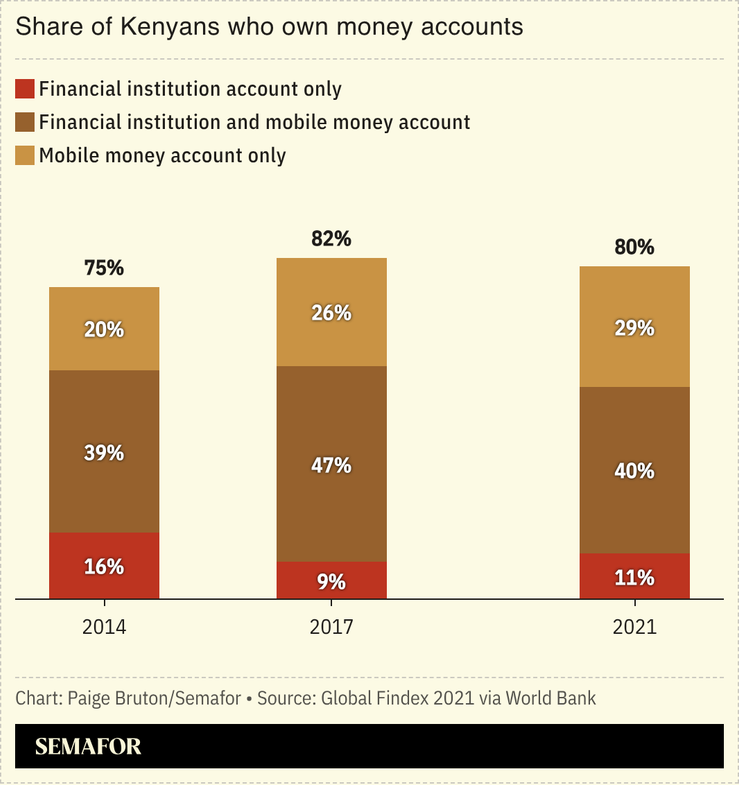

The country has one of the most advanced mobile money ecosystems in emerging markets, providing Kenyans with access to finance that is mobilized for everything from paying medical bills to launching businesses. Recent research showed that digital loan borrowers in Kenya saw higher incomes and improved employment prospects.

The growth of digital lending companies offers consumers more choice but, because the sector was once dominated by unregulated apps and predatory lenders, it has faced calls for tighter regulation: Growing complaints about exorbitant interest rates, data abuse, and unethical loan recovery practices led the Central Bank of Kenya to introduce regulations in 2022.