The News

The Trump administration is grappling with how to help Venezuela tackle billions of dollars in debt.

Caracas’ creditors are increasingly hopeful US involvement will help them recoup their losses. But it’s unclear how the US will grease the skids beyond incentivizing oil companies even after President Donald Trump said Tuesday he would sell millions of barrels of Venezuelan oil to “benefit” both nations.

“The prerequisites don’t really exist” for a currency swap like Argentina’s, said Brad Setser of the Council on Foreign Relations. He instead predicted officials would ease restrictions on new financing and suggested the Treasury Department could loan money from its Exchange Stabilization Fund as “a short-term bridge to an IMF program” — though the latter would be “insanely risky.”

“Everything’s on the table in terms of bringing the economy back into the first world,” said Sen. Bill Hagerty, R-Tenn., calling lifting restrictions “a logical set of incentives.”

“It’s difficult to speculate with any sort of specificity right now, but you can see lots of potential,” Hagerty added.

For now, creditors are mostly in the dark. Neither the White House nor the Treasury Department commented on next steps.

“My guess is that [Secretary of State Marco] Rubio and his team are not thinking a lot about Venezuelan debt right now,” Sen. John Kennedy, R-La., said.

Know More

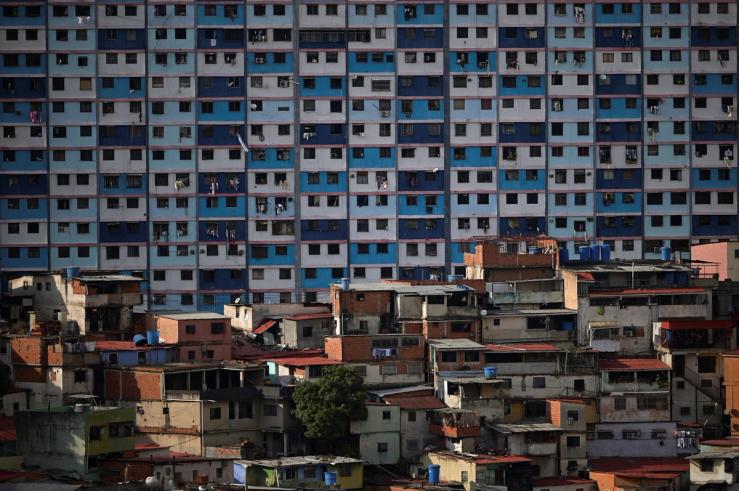

Venezuela defaulted in 2017 when it missed payments on bonds issued by its government and its state-run oil company. The country now owes tens of billions of dollars to a tangled web of creditors who are optimistic the US’ recent involvement could help speed a restructuring.

Among them: oil companies whose assets Venezuela seized several years ago. Trump on Monday suggested the US reimburse those companies in exchange for their help resuscitating Venezuela’s oil industry.

“The obvious thing is [Venezuela] get[s] back into the energy business,” Hagerty said. “They’d be in a better position, I would think, to address any sort of balance sheet issues.”

That could mean drafting the Export-Import Bank and International Development Finance Corporation to provide financial incentives. Still, specifics remain elusive — and any legislation would face long odds in Congress, where members on both sides of the aisle have expressed skepticism.

“I don’t want to pay the oil companies,” Sen. Josh Hawley, R-Mo., said.

Senate Foreign Relations Committee ranking member Jeanne Shaheen, D-N.H., pushed back on any financial assistance: “I think Venezuela’s debt should be paid by Venezuela.”

Notable

- One restructuring proposal would “combine Venezuela’s sovereign and oil-company debt” to “give the country only one baseline for pricing its debt and make the process more easily understandable,” Bloomberg reports.

- Trump plans to meet with energy executives this week, according to Bloomberg.