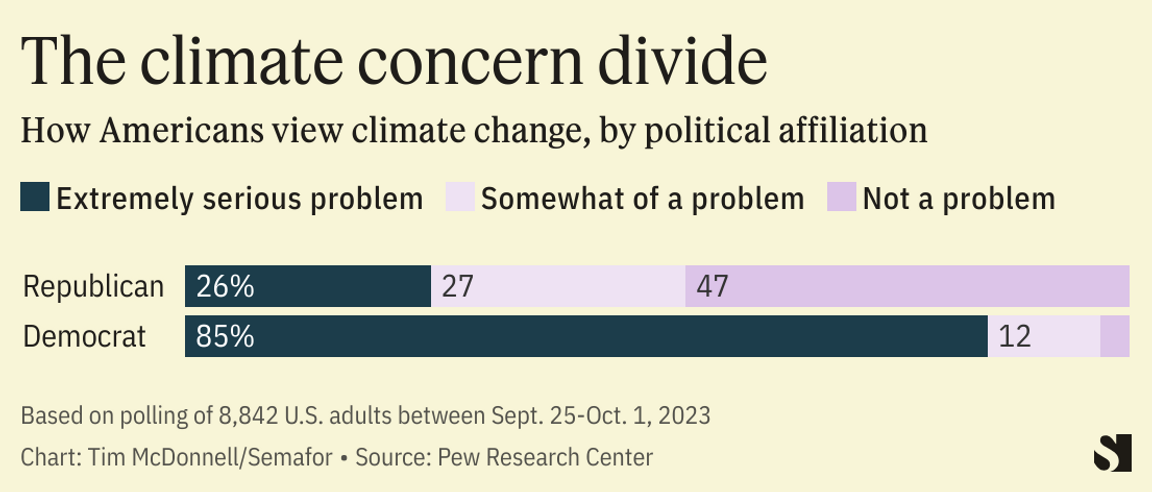

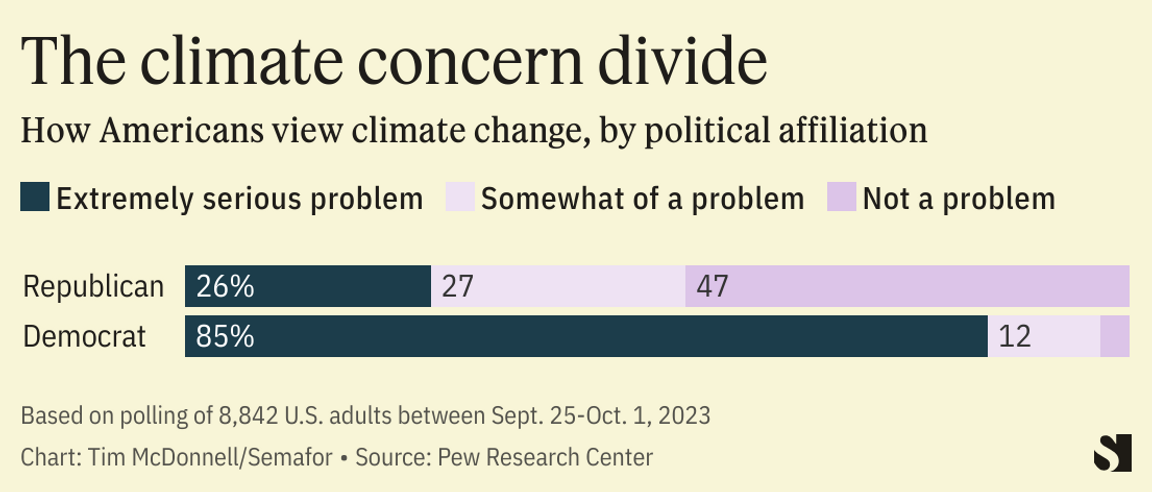

Bryan Olin Dozier via Reuters Connect Bryan Olin Dozier via Reuters ConnectTHE NEWS High-stakes climate and energy decisions are on the ballot in a number of U.S. state-level elections next week. Both Virginia and New Jersey are within a slim margin of flipping from Democratic to Republican control, putting major clean-energy and electric-vehicle initiatives at risk as many voters remain unaware of the economic benefits of Biden administration climate policy. Voters in Texas and Maine, meanwhile, will choose whether to place more control of their electric grids in the hands of fossil-fuel companies. TIM’S VIEW Next Tuesday’s off-cycle elections are important for climate in their own right, with emissions and clean energy investments on the line. They’re also a referendum on whether a core Biden administration argument — that the energy transition is a surefire win for jobs and economic growth — is getting through to voters in some of the states that have, up to now, moved most quickly to embrace it. In that sense, they’re a bellwether for 2024: If Tuesday delivers a sweep to state-level Republican candidates (off-cycle elections often have low turnout, a factor that in the U.S. tends to favor Republicans), it would bode ill for Biden and Congressional Democrats next year. Local governments are also critical gatekeepers for Inflation Reduction Act dollars, having the choice to apply, or not, for federal loans and grants to support investments in manufacturing facilities, job retraining, building efficiency upgrades, and other measures. So far, most post-IRA clean energy investment has flowed to Republican-majority states. But as the general election approaches, state Republicans may be more cautious about handing Biden any wins, and if next week’s elections consolidate Republican control of states with potential for growing clean energy sectors, the outflow of IRA money could slow.  On the other hand, whether they win this time or not, local Democratic candidates are key to informing voters about how they can benefit from the IRA, said Emma Fisher, deputy director of Climate Cabinet Action, an advocacy group that supports climate-focused candidates in local elections. Recent polling indicates that most voters aren’t aware of the law’s consumer-oriented tax benefits. “Local candidates are last-mile communicators,” she said. “The work they’re doing talking about the energy transition is laying the groundwork for that message to take seed in 2024.” |