| In today’s edition, we have a scoop from a Semafor event on Monday, when US antitrust cop Jonathan K͏ ͏ ͏ ͏ ͏ ͏ |

| Liz Hoffman |

|

Hi, and welcome back to Semafor Business, and happy Fed cut week.

I sat down last night in New York with Jonathan Kanter, the US Justice Department’s top antitrust official, for a wide-ranging discussion about competition, consolidation, and corporate power. He made some news that sent the M&A lawyers in the audience scurrying back to their offices: The DOJ is overhauling how it reviews bank mergers, worrying less about local branch overlap and taking a broader view of a financial ecosystem that’s changed a lot since the rules were last updated in 1995.

That decade’s wave of bank mergers were about building national branch networks, so it made sense to review them that way. Businesses and households generally got their loans from the same places they cashed their checks. It was all very tidy.

Today’s financial landscape is messy. Fintech companies, private equity, private credit, and insurers are huge sources or conduits of capital, and all will be subject to DOJ’s screening going forward. That’s long overdue, but the question is how much further Kanter & Co. take it, and whether they bring other bank regulators, of which America has a baffling number, along with them.

If Kanter is just looking for a new way to police bank mergers, that’s all well and good. I’ll be watching to see if it ushers in more scrutiny of lightly regulated cousins in the asset-management industry. Investment giants like Apollo and KKR have created parallel lending universes, vertically integrated to a degree that John Rockefeller would have admired. The Fed, in its role as the financial system’s safety cop, hasn’t been all that interested. The arrival of antitrust cops could be interesting.

Plus: Intel floods the zone, Brussels opts for an economic unity slate, management consultants turn the ax on themselves, and SEC chief Gary Gensler tries a stealth approach to policing private equity.

And a plug for our live journalism: Semafor’s The Next 3 Billion Summit is next week in New York, featuring Sierra Leone President Julius Maada Bio, Microsoft Vice Chair Brad Smith, NBA star Joel Embiid, WTO Director-General Dr. Ngozi Okonjo-Iweala, and others, on how to unlock one of today’s biggest social and economic opportunities: connecting the unconnected. Request an invitation here.

➚ BUY: Brussels. The EU’s top economic jobs went to officials who support regional coordination and joint spending to bolster its flagging economy. Brussels put Spanish, Italian, and French politicians in key posts overseeing regulation, spending, and industrial policy, and shut out Germany, whose grumpy isolationist turn has alienated its neighbors. ➘ SELL: Sprouts. Three biotech companies broke the IPO thaw this week and are all trading well, but marquee startups are still on the sidelines. Signs of life, but still a ways from the greenshoots of banker dreams hitting full bloom.

|

|

Banking has changed. Antitrust cops are finally catching up. |

THE SCOOP The US Justice Department will overhaul its reviews of bank deals and other mergers involving financial services firms, Jonathan Kanter, the agency’s top antitrust cop, told Semafor. The move will have major implications for the financial industry by casting a broader antitrust spotlight onto nonbank players, like private equity, private credit, and fintech companies that act as lenders. “Our analysis has to focus on market realities,” Kanter said, speaking at a Semafor event in New York Monday evening. The new rules would replace the DOJ’s existing guidelines, which focus on branch overlap and deposits when deciding whether two banks can merge. They could be announced as soon as Tuesday, a person familiar with the matter said. The DOJ’s guidelines for regulating bank mergers haven’t been updated since 1995, when ATM cards were cutting-edge and banks were offering toasters to new customers, Kanter said to an audience heavy on M&A lawyers. “As a result, it looks at things — narrowly — like branch overlaps [and] deposits. I don’t believe that is the appropriate, most state-of-the-art, effective way to think about concentration in banking.” The changes could cut both ways for banks looking to merge, potentially easing the path for community or regional lenders looking to shore up their deposit bases and cut costs by consolidating branches. The FDIC finalized its own approach to bank mergers on Tuesday, squarely in line with the DOJ’s. But a key consideration is whether the Federal Reserve, which reviews deals based on their impact on the financial system, among other criteria, is on board. It operates independently of the DOJ, which can still sue to block deals approved by the Fed.  FTI Consulting FTI Consulting |

|

Semafor Gulf launched this week with original reporting on the region’s financial, business, and geopolitical decisions shape the world — from the ground in Riyadh, Abu Dhabi, Dubai, and across the region. Join thousands of industry leaders who get Semafor Gulf in their inbox — read the latest edition here. |

|

“If the president wants to complain about it, he is free to do so just like everybody else. That doesn’t mean I have to listen.”

— Federal Reserve Gov. Christopher Waller, seen as a possible Fed chair, on Donald Trump’s views on interest rates |

|

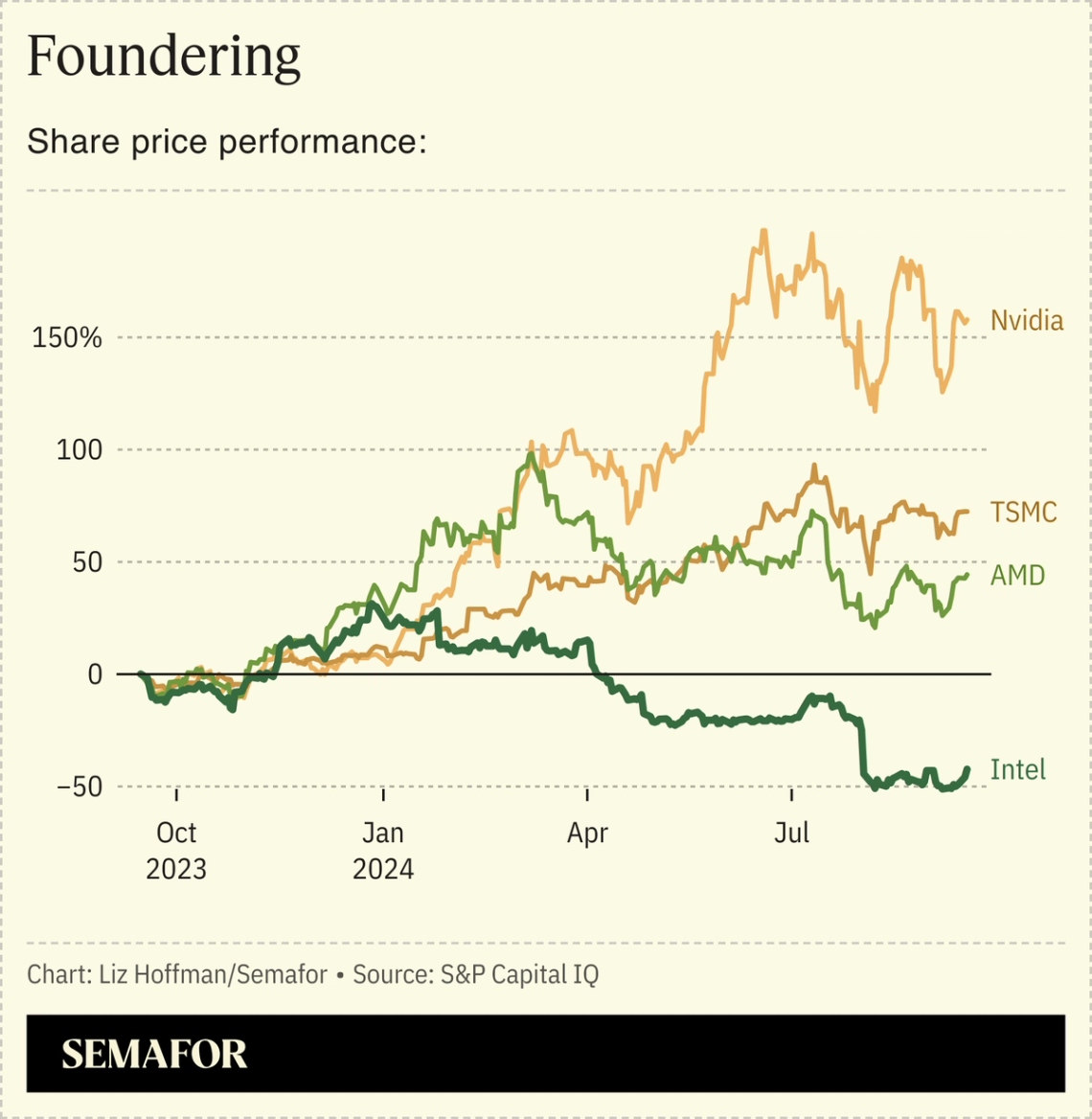

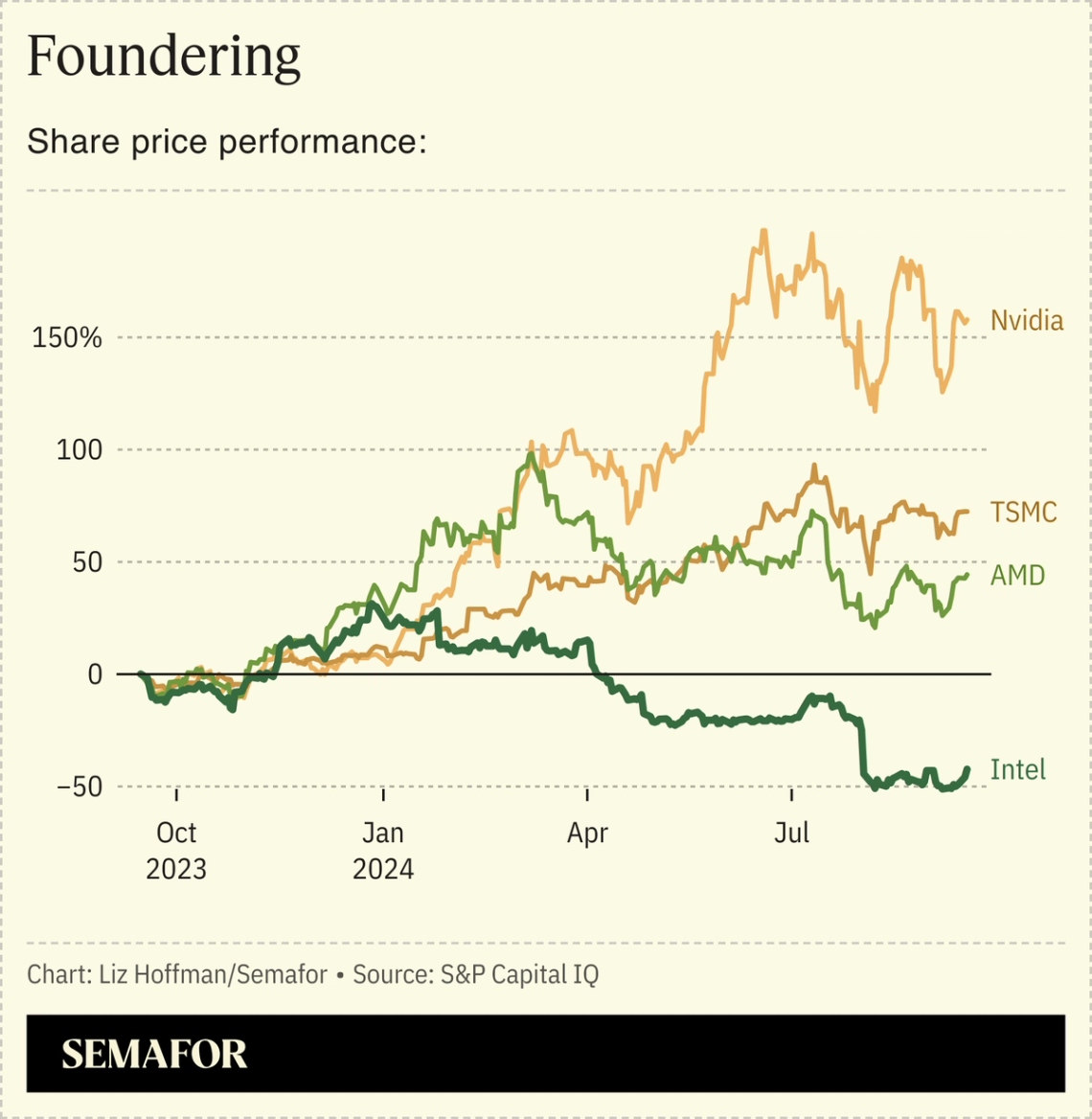

Conscious uncoupling: Intel is further separating its foundry business, which manufactures chips for other designers, giving it its own board of directors in a move that will make it easier to bring in outside investors. That’s a key step in ending a slow-moving disaster at one of America’s most iconic companies. The foundry arm accounts for one-third of Intel’s revenue, but all of its $3 billion in operating losses so far this year. The company threw a lot at investors: some good news (a new deal to produce semiconductors for Amazon and the prospect of another $3 billion in CHIPS money) and some bad (mothballing new plants in Germany and Poland). The flurry of headlines shows that Intel has, if not a foolproof plan, the concepts of one. Through the side door: When a federal judge struck down a Securities & Exchange Commission rule that would have policed fees and other financial arrangements that private-equity funds charge investors, it seemed like a win for the industry, whose lobbying arm took a victory lap. But privately, executives predicted that the SEC would try to do through its periodic firm examinations and litigation what it couldn’t do by fiat, sowing chaos and paranoia. That’s starting to happen: The SEC sued a Florida fund for misleading investors about redemption rights, something the tossed-out rule would have covered. |

|

Accenture is delaying promotions in the latest example of management consultants taking one of their favorite pieces of advice to clients — layoffs, or a flavor thereof. Over the past two years, McKinsey, Bain, and others have fired thousands of employees and warned thousands of others that their jobs are far from safe. Demand for consultants has waned as the economy lurches along, with companies neither pessimistic enough about the future to need their cost-cutting advice or optimistic enough to launch new products. Consultancies’ next great hope: AI. |

|