REUTERS/Yuri Gripas/File Photo REUTERS/Yuri Gripas/File PhotoTHE NEWS The International Monetary Fund’s climate change policies are making it harder for countries in need to tackle and adapt to climate change, a new report by a developing-country task force said. The Task Force on Climate, Development and the International Monetary Fund — a highly regarded group of experts and NGOs representing finance ministers from poorer and climate-vulnerable nations — wants the fund to give countries in need more flexibility to spend to combat climate change, rather than pursuing debt and deficit reduction, the IMF’s core mission. In essence, the report makes the case that these countries’ fiscal problems will be far greater if climate change destroys their economies. The task force’s report lists an array of areas where the IMF is “falling short,” including what the report’s authors characterize as the fund’s reliance on carbon pricing as a policy solution, narrow focus on fiscal tightening, and lack of appreciation of differing national economic and environmental circumstances. “There is a very clear need for the IMF to show much greater ambition in a number of areas,” Rishikesh Ram Bhandary, a climate-finance expert and a member of the task force, said in an interview. The criticism will bolster arguments for IMF reform at the annual meetings of the IMF and World Bank in Washington, D.C., in two weeks. (Register for Semafor’s World Economy Summit, held against the backdrop of the spring meetings.) The IMF said in response that it was open to different policy approaches, and acknowledged that climate change required huge financial investment, but insisted that even when it called for fiscal tightening, it urged countries to prioritize long-term growth prospects. PRASHANT’S VIEW The critique of the IMF — that it has made some progress, but not enough, and needs to move faster — hews close to the long-held belief in the developing world and among progressive economists that the IMF’s doctrinaire prescriptions end up hitting the poorest and most vulnerable hardest by advocating spending cuts in an effort to rein in debt. Yet the fund has also begun to find creative solutions for countries hit by natural disasters. It now supports the use of “disaster clauses” that allow governments to suspend debt payments in the event of hurricanes or other catastrophes, programs used by countries such as Grenada and Barbados. That, coupled with more aggressive climate rhetoric from the IMF’s leadership, suggests it is open to change. KNOW MORE The IMF’s focus on carbon pricing, in particular, illustrates the extent of its challenge, Bhandary said. For one, the task force’s research indicates carbon pricing alone will not raise sufficient revenues to pay for the huge economic shifts required as a result of climate change. The very nature of carbon pricing — whereby companies and individuals are incentivized to cut their emissions because they pay for each unit of carbon they are responsible for — also means those already-insufficient revenues will decline over time. And from a purely political point of view, the carbon pricing policy “lacks widespread buy-in … among advanced and developing countries,” the report noted. STEP BACK Among the major issues facing developing countries — which was noted in the task force report — is how fast-increasing interest rates in the West have made borrowing much more expensive for poorer nations, a particular problem when it comes to climate change because renewable-energy projects are capital-intensive. At the same time, many of these countries are grappling with high levels of public debt, exacerbated by heavy borrowing during the worst of the pandemic.  THE VIEW FROM KENYA One-size-fits-all climate models have “fundamental inadequacies” when it comes to addressing pressing issues for the Global South, and in particular Africa, according to Murefu Barasa, Nairobi-based managing partner at EED Advisory, a Pan-African consultancy. They tend to over index on emissions from sectors like manufacturing and transport, and gloss over categories that result in high levels of local pollutants, such as food preparation. “It doesn’t mean that there are no lessons from the West that can be adopted here,” Barasa said in an interview, “but you can’t just copy and paste these things.” THE VIEW FROM INDONESIA IMF guidance to Indonesia illustrates the disconnect between the fund’s advice and its demands. Last year, it issued guidance to Jakarta that “emphasises green financing, promotes climate change mitigation, and supports climate-friendly tax policies,” a study published in November noted. Yet it also pressed for significant austerity measures. “The IMF needs to change its approach … especially by promoting investments in renewable and sustainable energy,” one of the study’s authors noted. ROOM FOR DISAGREEMENT Despite its shortcomings, the IMF does not need a radical overhaul: As Dileimy Orozco, an international climate-finance expert at the London-based think tank E3G noted, the fund’s official mandate is to promote “global macroeconomic and financial stability,” and climate change presents a major threat to that. “There is a lot that the IMF could do within its current mandate,” Orozco said in an interview. The IMF also disputed that it is overly committed to carbon pricing, that it underestimates the extent of financing required, or that it imposes a one-size-fits-all solution on countries that come to it for help. “We have stressed repeatedly that the climate transition comes with large financing needs,” a fund spokesperson said, adding that “in cases where the IMF recommends consolidation, the IMF typically advises countries to consolidate in ways that don’t undermine long-term growth prospects,” and which “protect the vulnerable, and protect the environment.” NOTABLE - The World Bank wants to significantly expand its lending capacity to help it deal with climate change, as well as other global crises, Reuters reported in January, citing a roadmap document set to be discussed at the spring meetings.

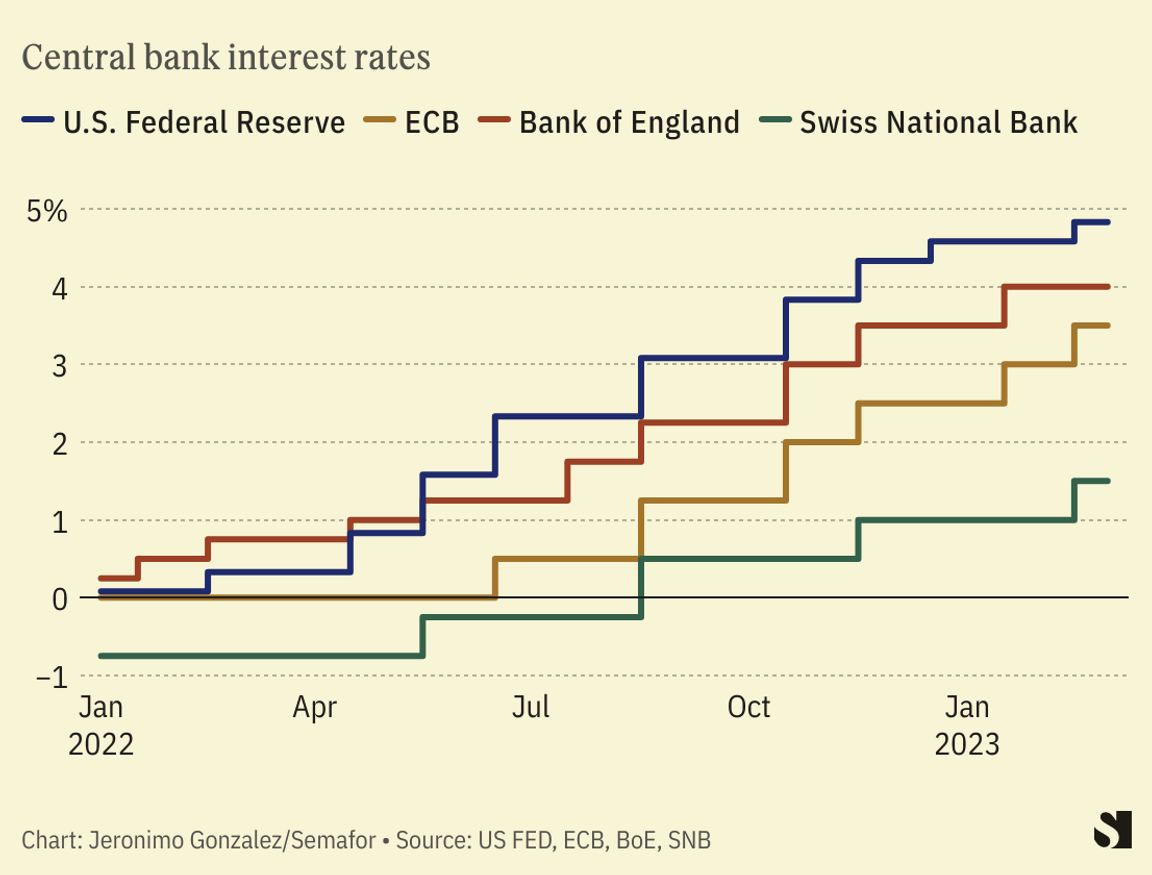

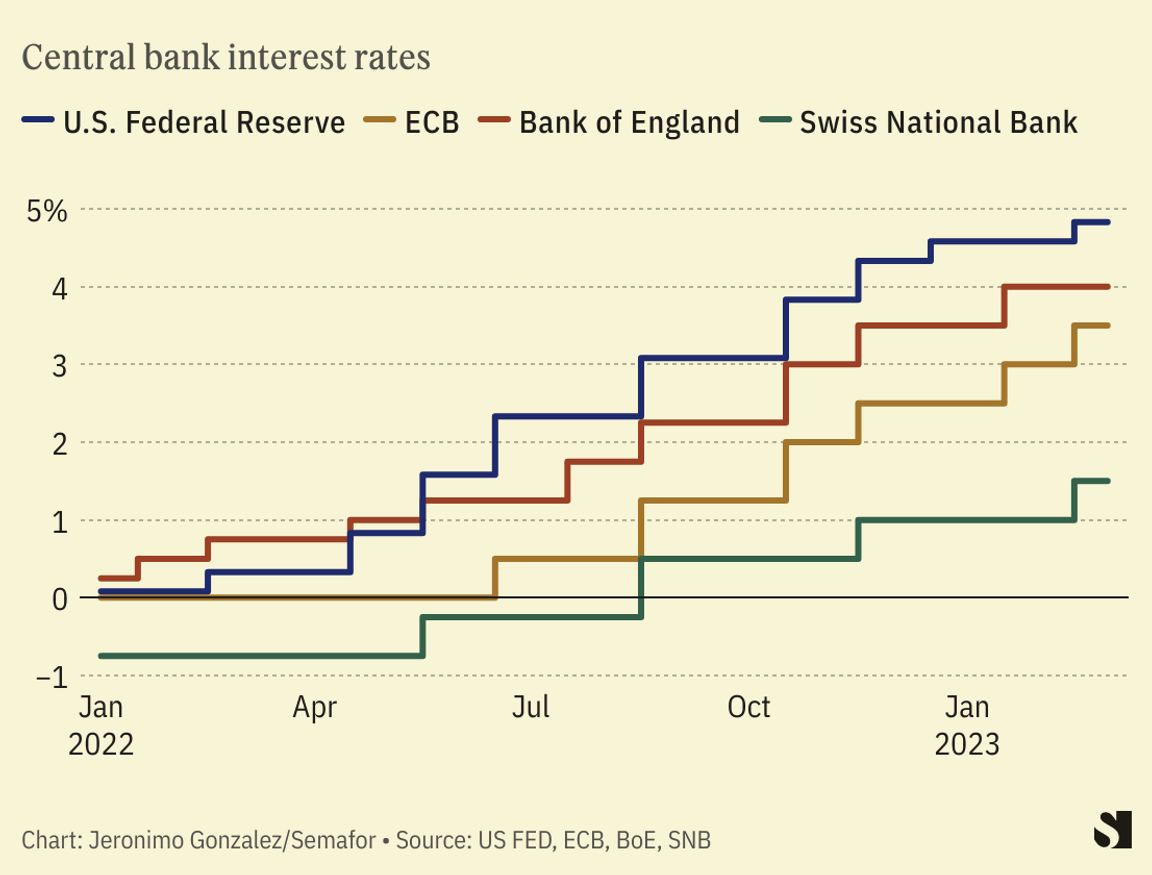

|