| After a hellacious year, wind companies are slowly staking out a path to profitability.͏ ͏ ͏ ͏ ͏ ͏ |

| Tim McDonnell |

|

Hi everyone, welcome back to Net Zero.

The Biden administration finally got its chance to respond to critics of its recent pause on liquefied natural gas export permits. Its main justification: The world market — at least the part the U.S. wants to serve — probably has enough gas already. The purpose of the pause, Deputy U.S. Energy Secretary David Turk told a Senate hearing, is to make sure the U.S. doesn’t build any more LNG export capacity than “what our allies absolutely need.”

Setting aside that the pause is also at least partially a political stunt aimed at winning climate voters in the upcoming election, Turk’s argument captures why LNG is so controversial. For industry advocates, U.S. LNG served as a critical defense for Europe against Russia, and has done as much as any technology to reduce net carbon emissions in China and other Asian countries which have substituted it for coal in the power sector.

The key question is how long those trends can last. Europe is already satisfied, and analysts expect LNG demand there to peak next year, well before any new U.S. LNG projects would be operational. More growth is possible in Asia, especially in China. But Turk’s reference to “allies” suggests the administration may be less enthusiastic about compromising its own climate goals (and reelection chances) in order to serve China. That’s especially true since, as the ever-astute climate columnist David Roberts observed, the only scenario in which U.S. LNG continues to offset global coal emissions beyond 2030 is one in which renewable energy deployment has fallen far off track, and the world has blown well past the Paris Agreement targets. For those in industry who see those targets as unrealistic, however, every LNG molecule the U.S. doesn’t sell is one that Qatar will.

If you like what you’re reading, spread the word.

- Offshore wind’s recovery

- Barclays bails

- EV ad kerfuffle

- Buyback bonanza

- A decisive oil boom

Ain’t scared by Exxon, and climate deniers get denied. |

|

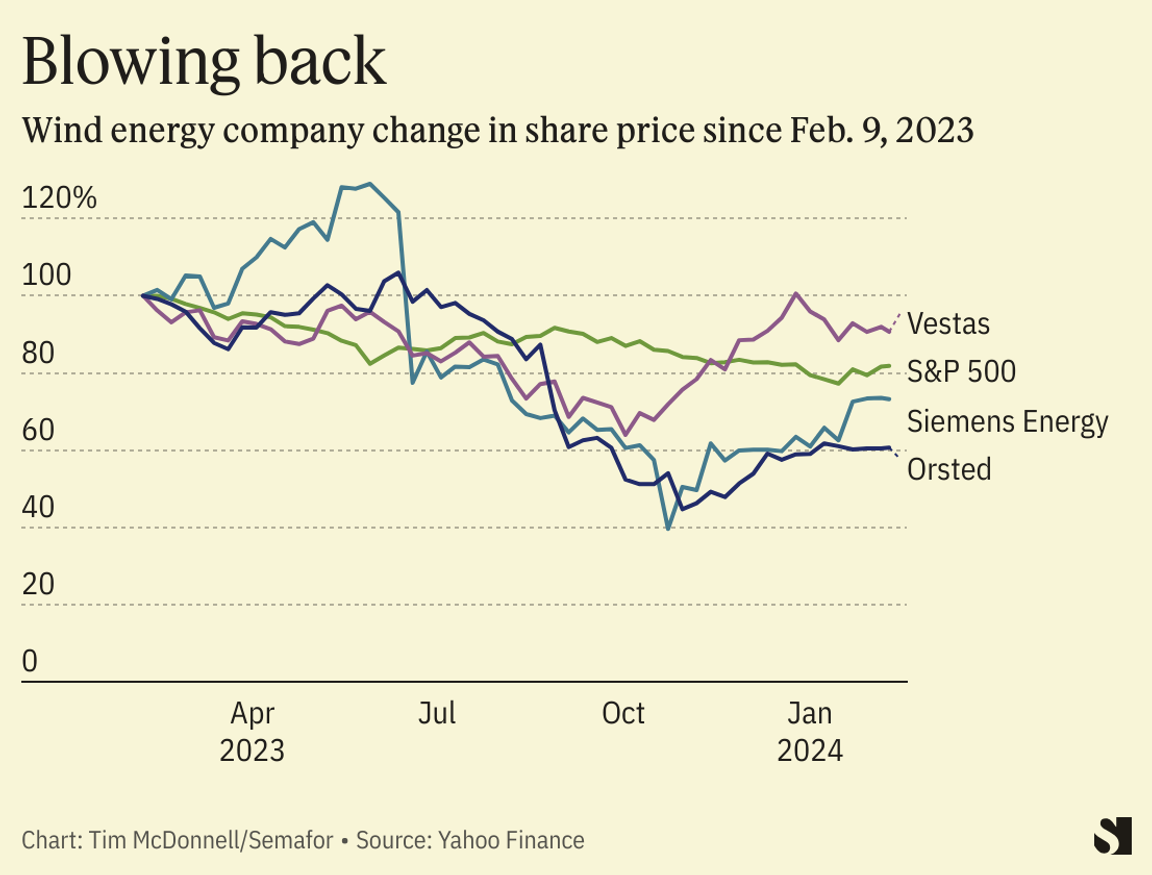

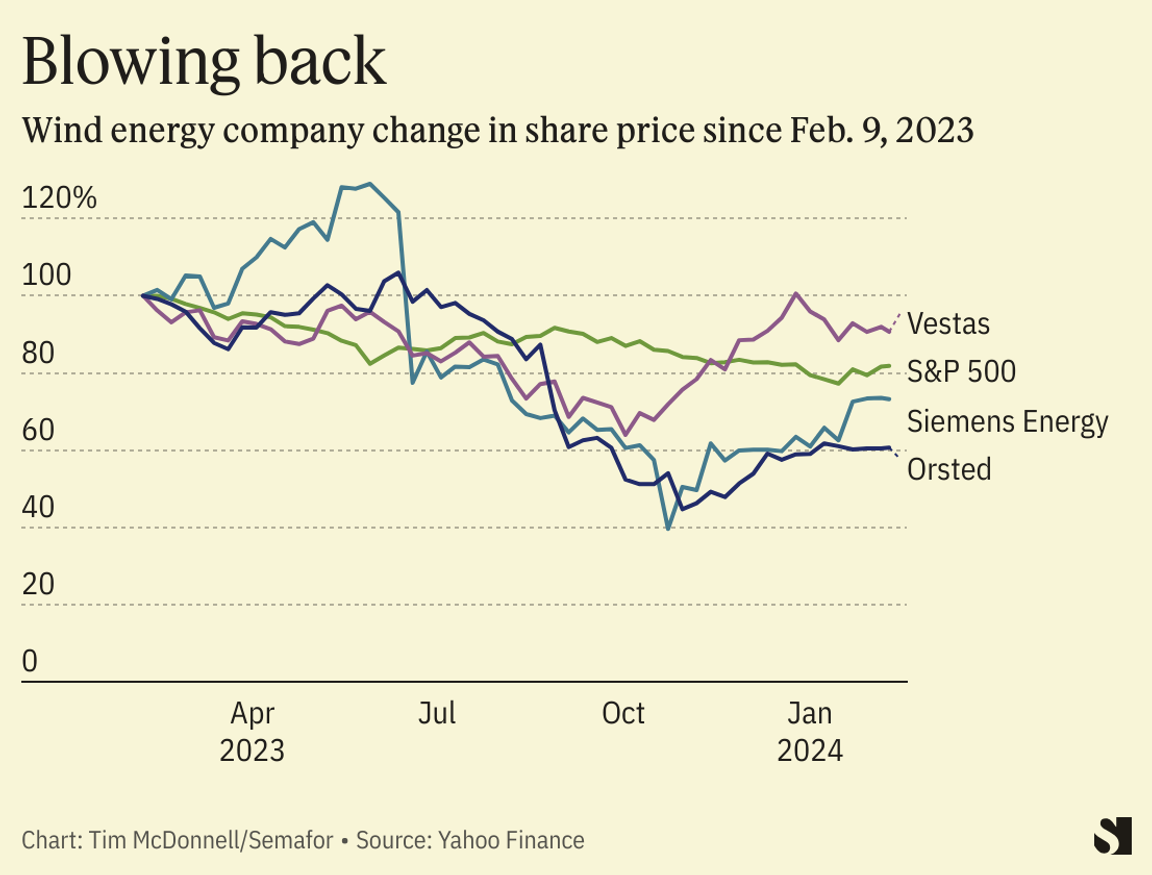

Last year was hellacious for big U.S. and European offshore wind companies. But their latest results offer some cautious optimism that the worst may be over, that they are tightening their belts, and taking baby steps toward profitability.  In annual earnings reported this week, Danish wind farm developer Orsted posted a net loss of $2.9 billion for 2023, cut 9% of its workforce, and said its chairman would step down after a decade. Siemens Energy warned its turbine-manufacturing subsidiary was still dragging the company down with hundreds of millions of dollars in losses. And Vestas, despite turning a profit, suspended its dividend payments. But each also offered kernels of good news for investors, with Orsted curbing spending, Siemens closing in on offshore wind profitability, and Vestas offering a better profit outlook for 2024 than Wall Street had feared. Offshore wind has a chance for a reset, both because of actions executives are taking to stem their losses, and because of improving market conditions: Interest rates may fall this year — particularly important for offshore wind, because companies often borrow to make huge upfront capital expenditures — and governments are beginning to reset their expectations. |

|

Barclays bails on drilling |

| |  | Karina Tsui |

| |

REUTERS/Stefan Wermuth/File Photo REUTERS/Stefan Wermuth/File PhotoBarclays pledged to stop directly financing new oil and gas projects and move its capital towards supporting companies engaged in decarbonization, the British bank said in a statement Friday. Part of the plan will halt direct financing for any oil extraction projects in the Amazon or the Arctic Circle, the BBC reported, and will also introduce restrictions on funding coal mines. The move is part of Barclays’ updated climate strategy and follows intense criticism from climate experts and activist investors over the bank’s involvement in fossil fuel programs. Barclays’ was previously Europe’s largest funder of its oil and gas industry and is currently Britain’s biggest lender to the sector. While responsible investment group ShareAction welcomed Barclays’ move, the group also said that changes don’t do enough to make a genuine impact on cutting oil and gas financing. “For [the changes] to have teeth, the bank must demand clients stop engaging in activities that increase the climate crisis,” said ShareAction’s campaign manager Kelly Shields. Barclays’ announcement follows similar moves by other banks like HSBC, BNP Paribas, and, in the U.S., Bank of America. The American bank, however, appeared recently to be backtracking on efforts to completely stop financing new coal mines — a pledge that it had made two years ago. |

|

REUTERS/Anushree Fadnavis REUTERS/Anushree FadnavisElectric vehicles can’t be advertised as “zero emission,” the U.K.‘s advertising watchdog ruled this week. The decision targets ads from automakers BMW and MG, which had used that description for EVs and hybrids in a way that is misleading to consumers because it discounts emissions related to the vehicles’ manufacture and from electric power plants. The Advertising Standards Authority has been on a crusade against greenwashing, and while the lifecycle emissions of a typical EV are far lower than an internal combustion engine car, it’s true that they aren’t “zero.” Both companies removed the language from their ads. |

|

Spending on share buybacks and dividends by the top five oil and gas majors in 2023, a record. That’s about 75% higher than the average during the mid-2010s boom years, when oil prices were much higher than they are today, according to Bloomberg. It’s a sign that executives are scrambling to keep investors interested in stocks that are trading at far lower multiples than many other sectors of the economy. |

|

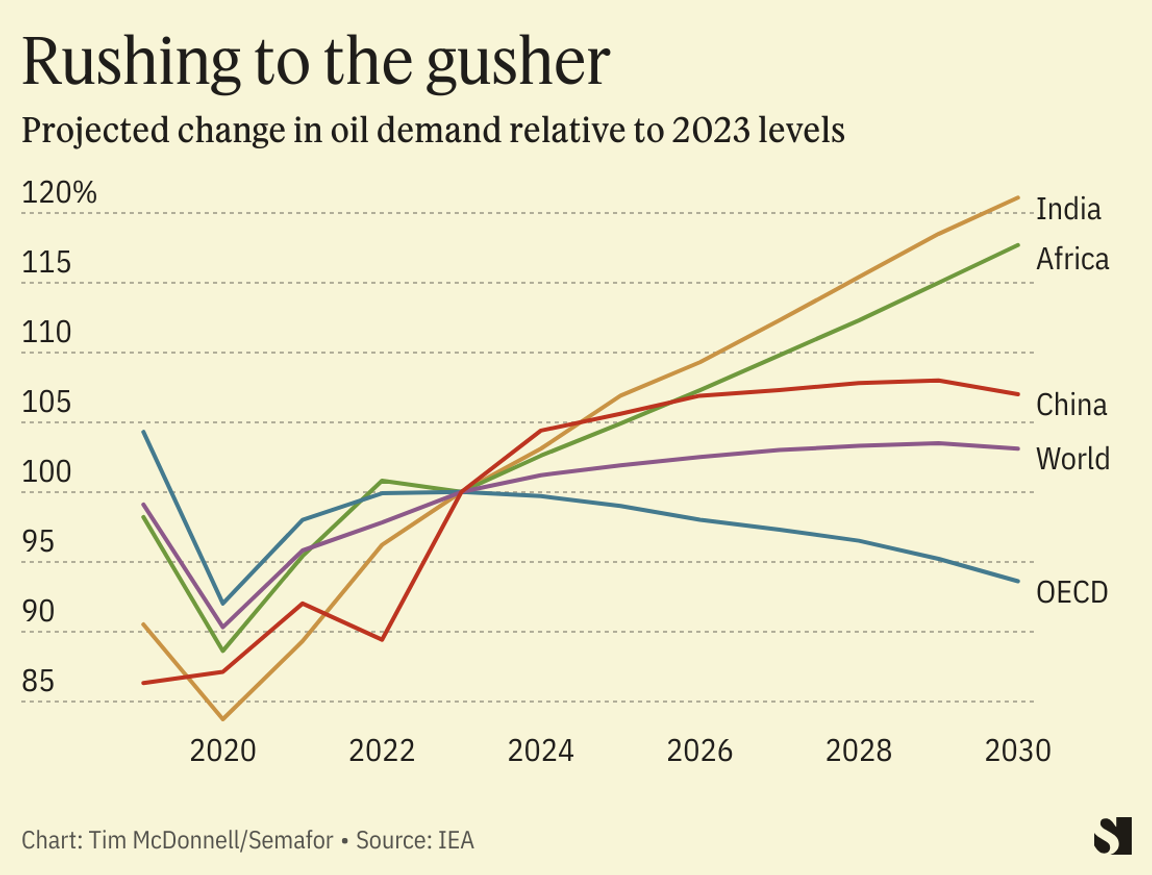

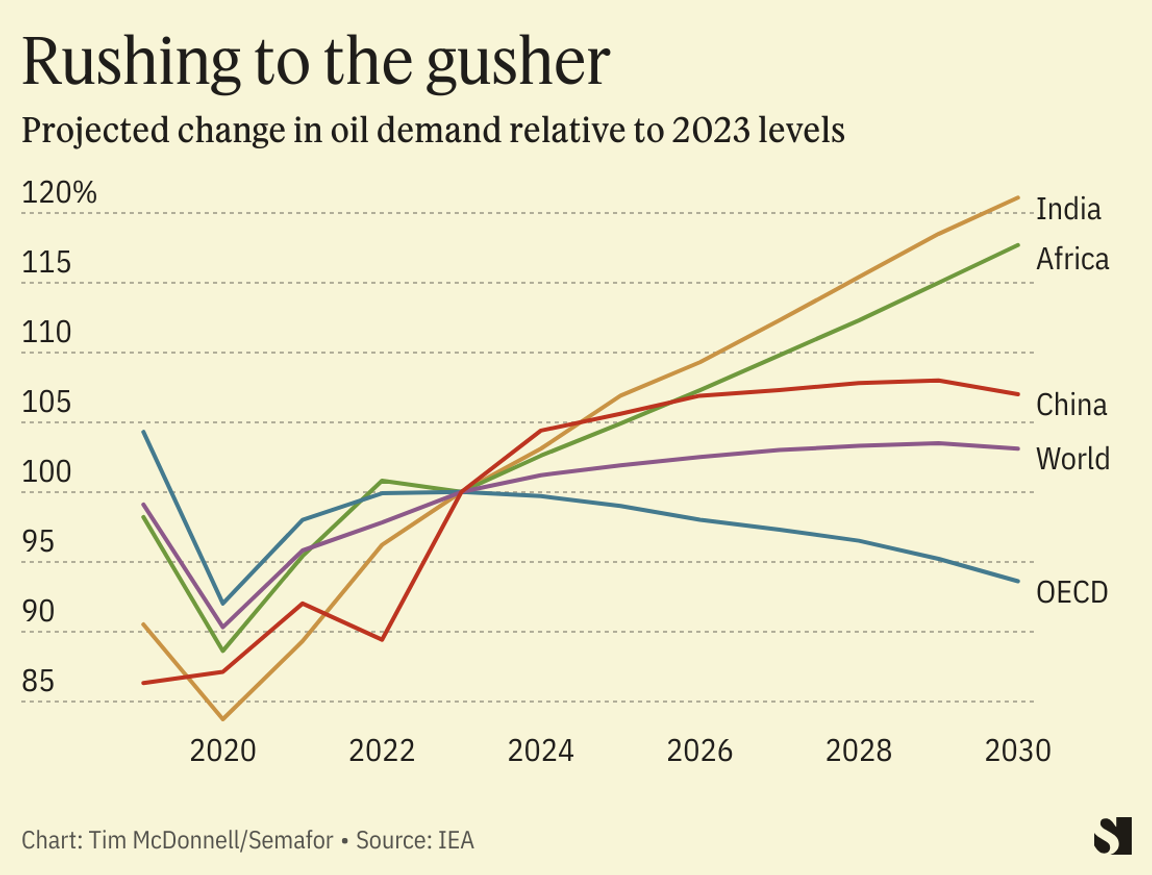

India is edging out China as the leading venue for oil demand growth, a new International Energy Agency analysis concludes.  The biggest share of that growth will be for diesel products, the IEA forecasts, meaning that the rate of electrification of heavy industry and commercial transport in India is arguably one of the most decisive metrics in the global energy transition. The increase in oil demand for use in passenger vehicles is expected to be moderate, thanks to a growing rate of EV adoption. India’s booming oil demand is a vulnerability for its economy, the IEA warns, since the country is mostly dependent on imports. |

|

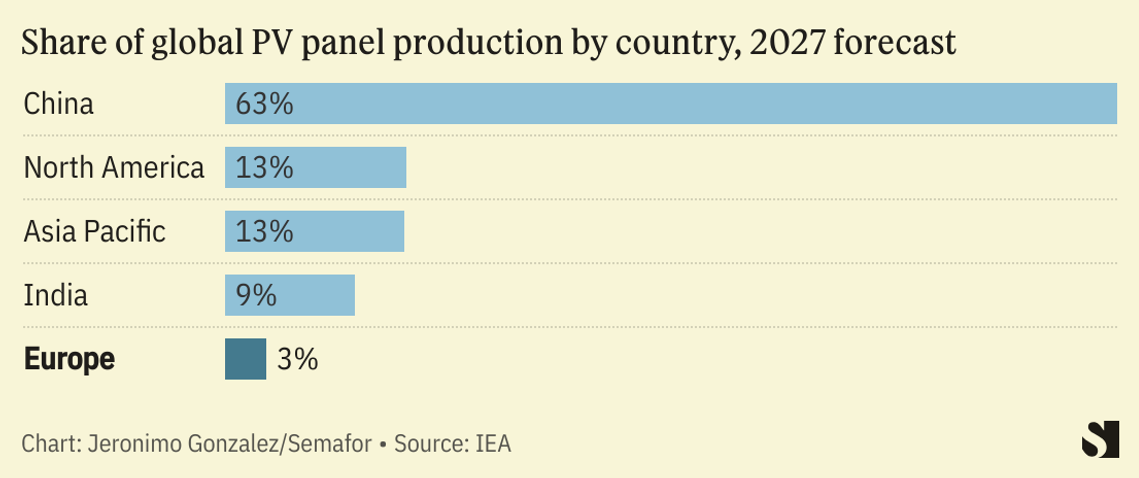

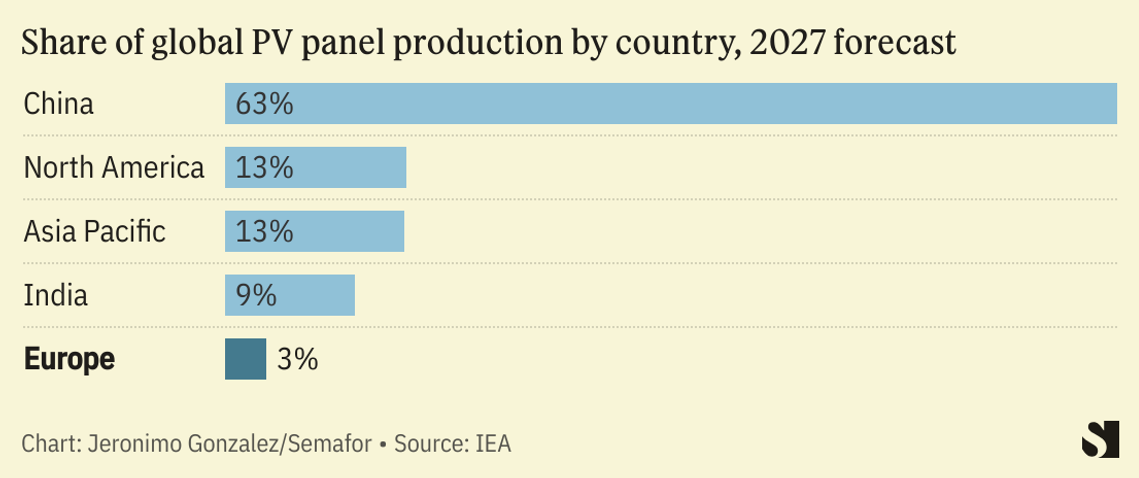

New Energy  - Europe needs a strategic solar panel stockpile, a group of energy economists warned. Protecting domestic solar manufacturers from competition with China is counterproductive, they argue: Instead, governments should take advantage of cheap imports to guarantee there’s a steady stream of panels available for installers — which, compared to manufacturers, are a larger source of jobs and economic benefits for Europeans — in case of future global trade disruptions.

- Meanwhile, in the U.S., many of the biggest solar factories under development are being built by Chinese companies. The companies that already dominate the global solar supply chain are able to get up and running faster than their new U.S. rivals, even without their home court advantage.

Fossil Fuels - Brazil is keen to sign a long-term LNG supply deal with Qatar, the chief of its state oil company said this week. Qatar is looking to undercut U.S. exporters, and although LNG daily spot prices are likely to fall in the future, Brazil seems willing to lock itself into higher prices in exchange for a guarantee that it won’t be cut out of the limited global LNG supply if demand in Asia gathers steam.

Finance- The head of the world’s largest sovereign wealth fund criticized ExxonMobil for pursuing a lawsuit against two activist investors. Norway’s oil fund, one of Exxon’s top 10 shareholders, opposes any steps to remove shareholder rights, executives said.

Tech- Scientists set a new record for energy produced by nuclear fusion. The Joint European Torus facility in Oxford, England, sustained a fusion reaction for five seconds, generating 69 megajoules, or “enough to boil about 70 kettles,” according to the Financial Times. The experiment still consumed far more energy than it produced, but it’s another step along the road to viable fusion energy.

- Twelve, a climate tech startup, launched its commercial-scale carbon transformation unit, a major step in its bid to produce sustainable aviation fuel. The California-based company, which generates carbon credits for companies including Microsoft and Shopify, is set to complete a production plant later this year.

Personnel- Climate scientist Michael Mann won a defamation lawsuit he brought a decade ago against two climate-denying commentators. The judgment of about $1 million is “a victory for science,” Mann said in a statement. Now, his lawyers plan to go after the commentators’ publishers — the Competitive Enterprise Institute think tank and the magazine National Review.

|

|

Pedro Henriques da Silva, director of the Sierra Club Foundation’s Shifting Trillions Initiative, which filed a shareholder resolution this week at Goldman Sachs demanding it assess the “environmental justice impacts of its energy and power sector financing.”  |

|