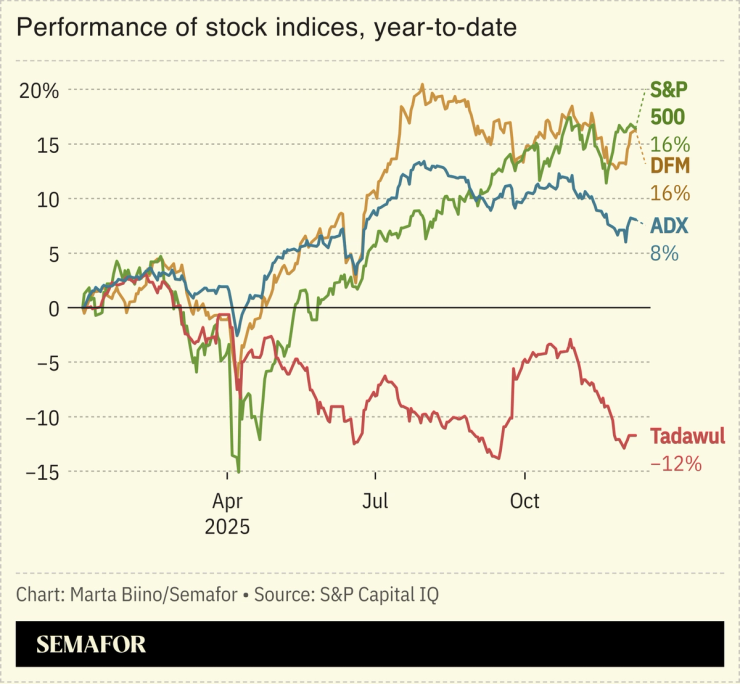

Diversification has been the buzzword in the Gulf, but oil prices — largely a barometer of external forces — remain the defining metric of the region’s future fortunes, even if their impact is not uniform.

Changes in crude prices are most acutely felt in Saudi Arabia, where rapid social and market reforms haven’t loosened the economy’s link to oil, Morgan Stanley analysts wrote in a recent report. When prices decline, deficits widen, and Riyadh’s pitch to foreign investors is weakened.

By contrast, the UAE is more immune to crude swings. Its broader economy derives more growth from a population boom, tourism, logistics, trade, finance, and technology, according to Morgan Stanley, which is bullish on the country.

Even energy is a winner: the New York investment bank has a “buy” on ADNOC Drilling and ADNOC Distribution, the state oil company’s retail arm. UAE banks are also flush, with deposits outpacing lending, and spurring expansion abroad. Some of that cash is increasingly finding its way to Saudi Arabia, where Vision 2030 demands are driving credit needs.

Still, relatively lower oil prices haven’t eliminated opportunities in the kingdom: Foreign firms are flocking to Riyadh. Goldman Sachs, Citi, and Morgan Stanley, among others, have all established a regional headquarters, which is required to do business with the Saudi government and the almost-$1 trillion Public Investment Fund.