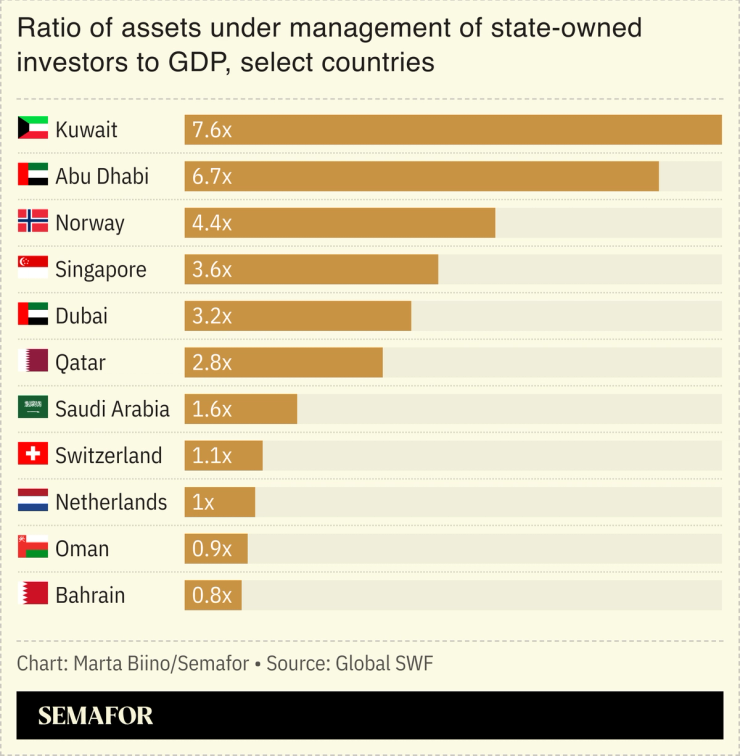

Kuwait controls more wealth as a proportion of its GDP than its regional peers, according to a new study by data platform Global SWF.

While the Gulf nation’s economy lacks the dynamism of some of its neighbors, it has amassed $1.2 trillion worth of assets across its sovereign wealth funds, central bank, and public pension funds, equivalent to 7.6 times its economic output. That’s higher than Abu Dhabi, which is wealthiest in absolute terms, controlling investments of $2.2 trillion, 6.7 times its GDP.

The latest Global SWF report also showed that the Qatar Investment Authority was the biggest spender among global sovereign funds in November, deploying $4.5 billion. The QIA is set to become increasingly active, as it looks to invest an expected windfall from the country’s expanding gas exports.