There’s too much pessimism in oil markets these days, at least according to one prominent expert.

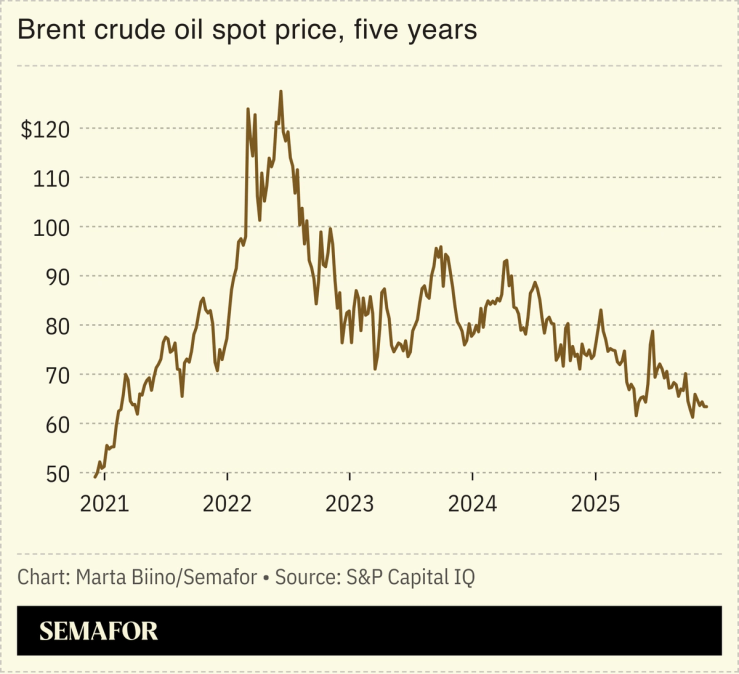

While many analysts see a glut coming — the most bearish forecast from JPMorgan puts global benchmark Brent at $30 a barrel by 2027, albeit in a scenario it views as unlikely — the long-term view of oil sticking around $60 a barrel also misses the mark, according to Bloomberg’s energy and commodities columnist Javier Blas.

Annual demand is still rising close to the historical average, an increase that should clear a market overhang by 2028 and push prices higher. So while oil could trade in the $40s next year, it will likely rebound to above $75 by 2030, Blas writes.

Gulf producers aren’t buying the market’s pessimism, either.

Kuwait, Qatar, Saudi Arabia, and the UAE are investing aggressively at home and abroad, expanding output capacity, pouring billions into exploration, and building trading and refining arms.

If their bet on higher prices pans out, it will also help countries that are borrowing to diversify their economies to plug their deficits over the next decade.