Bahrain’s sovereign debt has been pushed further into junk status, after S&P lowered its credit rating on the country from B+ to B. It is the first cut by one of the big three agencies since 2020, but may not be the last: Fitch placed Bahrain on negative outlook this year.

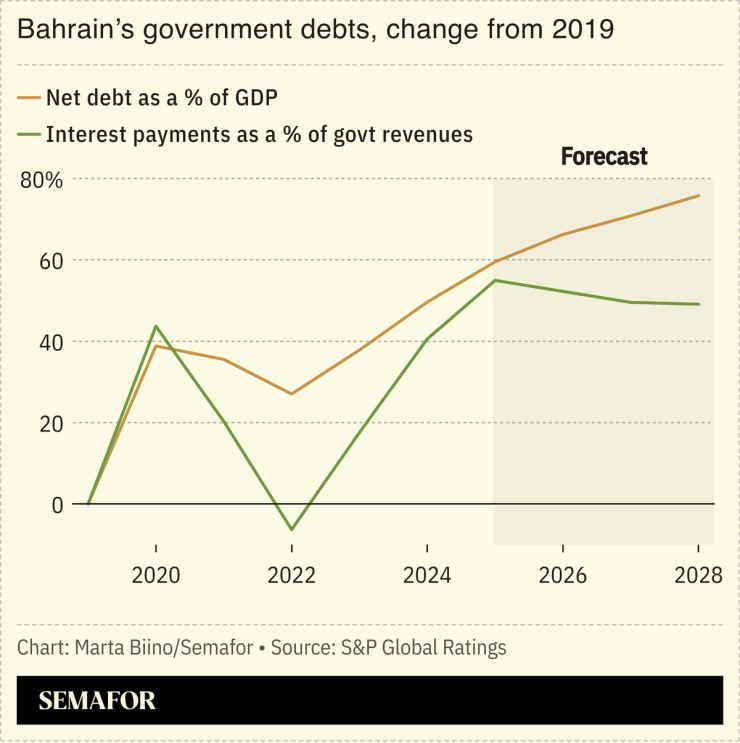

S&P cited high government debts and persistent budget shortfalls for its move. It expects the deficit to hit 7.6% of GDP this year, amid subdued oil prices and the government’s reluctance to trim spending for fear of a public backlash. Debt-servicing will eat up a third of government revenue this year and overall debt is expected to reach 139% of GDP by 2028. On Monday, the IMF also urged the authorities to consider a corporate income tax and slashing subsidies.

Some small steps are being taken. This week the government cut the investment required for its Golden Residency program by a third to $345,000 to encourage more capital inflows.

Separately, S&P upgraded Kuwait’s sovereign credit one notch, pointing to the country’s strong balance sheet. The agency says reform momentum is helping cushion the risks of oil dependence and high spending.