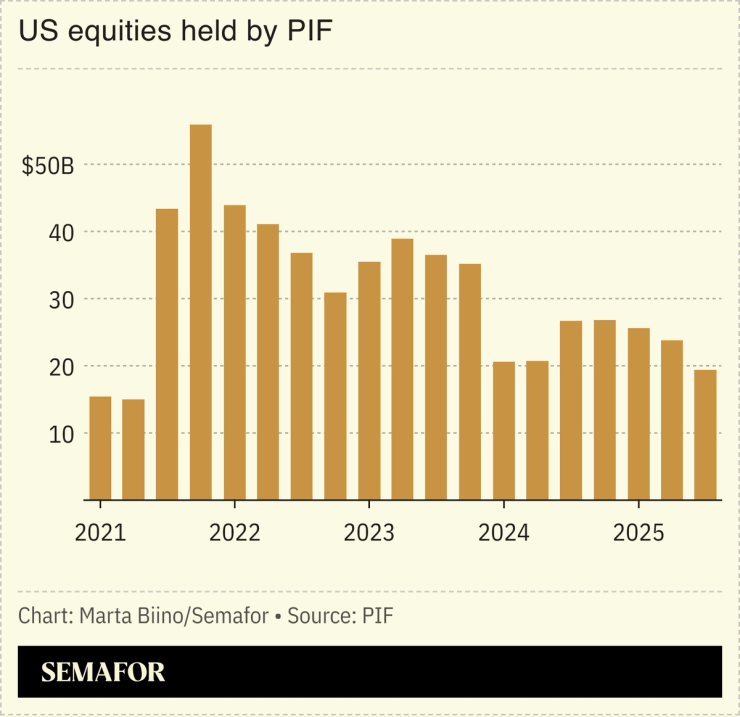

Saudi Arabia’s sovereign wealth fund cut its holdings of US equities to the lowest level in four years, just weeks before a White House meeting between the kingdom’s de facto ruler and President Donald Trump.

Public Investment Fund reduced its US stock exposure to $19.4 billion at the end of September, from $23.8 billion three months earlier, according to an SEC filing. The fund sold down stakes in firms including Pinterest and Air Products along with call options on companies including Amazon and Apple.

The sales leave the PIF holding just US six stocks, including Uber, Lucid, and Electronic Arts, the videogame publisher that is set to be taken over by a Saudi-led consortium.

PIF loaded up on US equities during the pandemic slump. It has since reduced holdings from a peak of $56 billion in 2021 as lower oil prices and vast spending commitments at home have led the fund to step up borrowing and recycle existing cash to use elsewhere.

Since then it has leaned more into commercial deals, spending billions on everything from Boeing planes to hiring US firms like Parsons and Bechtel to work on Saudi projects.