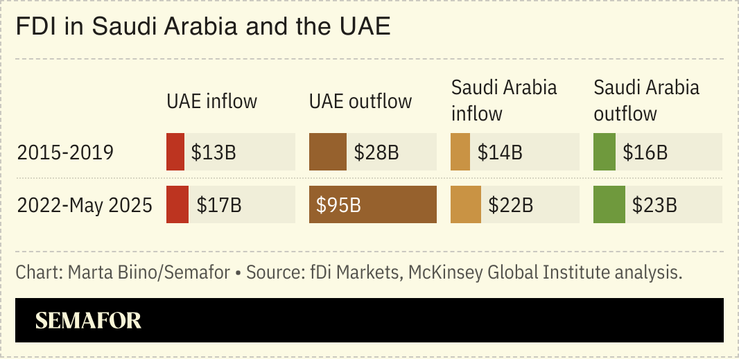

Announced outward investment by the UAE has soared over the past few years, cementing the country’s position as a key source of international capital, while announced foreign investment into Saudi Arabia surged, according to data sourced from a McKinsey Global Institute report.

Foreign direct investment flows to Saudi Arabia between 2022 and May this year surged by 60%, while outward investments only rose by 46%. That flipped the country’s traditional relationship with global capital flows: the kingdom now attracts more investment than it exports. While that’s good news for Crown Prince Mohammed Bin Salman’s plan to get foreign companies to invest in his economic transformation project, it’s bad news for those that had relied on Saudi cash from oil sales recycling through the global economy.

The UAE, on the other hand, has massively ramped up its role as an exporter of capital. Outflows more than tripled to $95 billion, far surpassing the $17 billion of investment it attracted.