The Scoop

The natural gas industry is entering a period of major price swings as rising global demand runs into bottlenecks on pipeline and export infrastructure, the head of the largest US gas producer told Semafor, creating risks but also lucrative new opportunities for arbitrage.

While the US has no shortage of untapped gas underground, it is beginning to run low on gas in many of the traditional drilling hotspots best connected to existing distribution networks, Expand Energy CEO Nick Dell’Osso said. Between growing power demand from data centers and factories in the US, and increased electricity usage by a growing middle class in Asian and African countries, the world is clamoring for more gas, which will likely drive prices up. But in the next few years, as pipelines expand within the US and a succession of new LNG import and export terminals come online globally, new supplies will hit the market in “large, chunky volumes,” Dell’Osso believes, which will cause periodic price crashes. Successful drilling companies will need a strategy to quickly dial up or down their production, he said. And for Expand — born last year from Chesapeake Energy’s $7.4 billion acquisition of its rival Southwestern — size matters.

“If you’re better at responding to volatility, then you position your company for better returns. It’s easier to do that as a larger company where you’ve consolidated the best assets,” he said. Expand doesn’t have any specific new acquisitions in its sights, Dell’Osso said, but always has its ear to the ground, with the caveat that “M&A has to make you better, not just bigger.” And in the meantime, Dell’Osso is also building out the company’s marketing division, buying and trading gas between a variety of buyers and sellers, “pretty significantly,” to seize on upcoming opportunities.

Tim’s view

At a glance, the next few years look like halcyon days for the gas industry. Global demand is projected to hit an all-time high next year. The capacity of gas power projects under development in the US is twice what it was a year ago. Longer-term, gas — with lower emissions than coal and a wide array of hard-to-replace applications — could take decades longer than other fossil fuels to be undercut by the clean energy transition. Yet there’s turbulence ahead for industry leaders.

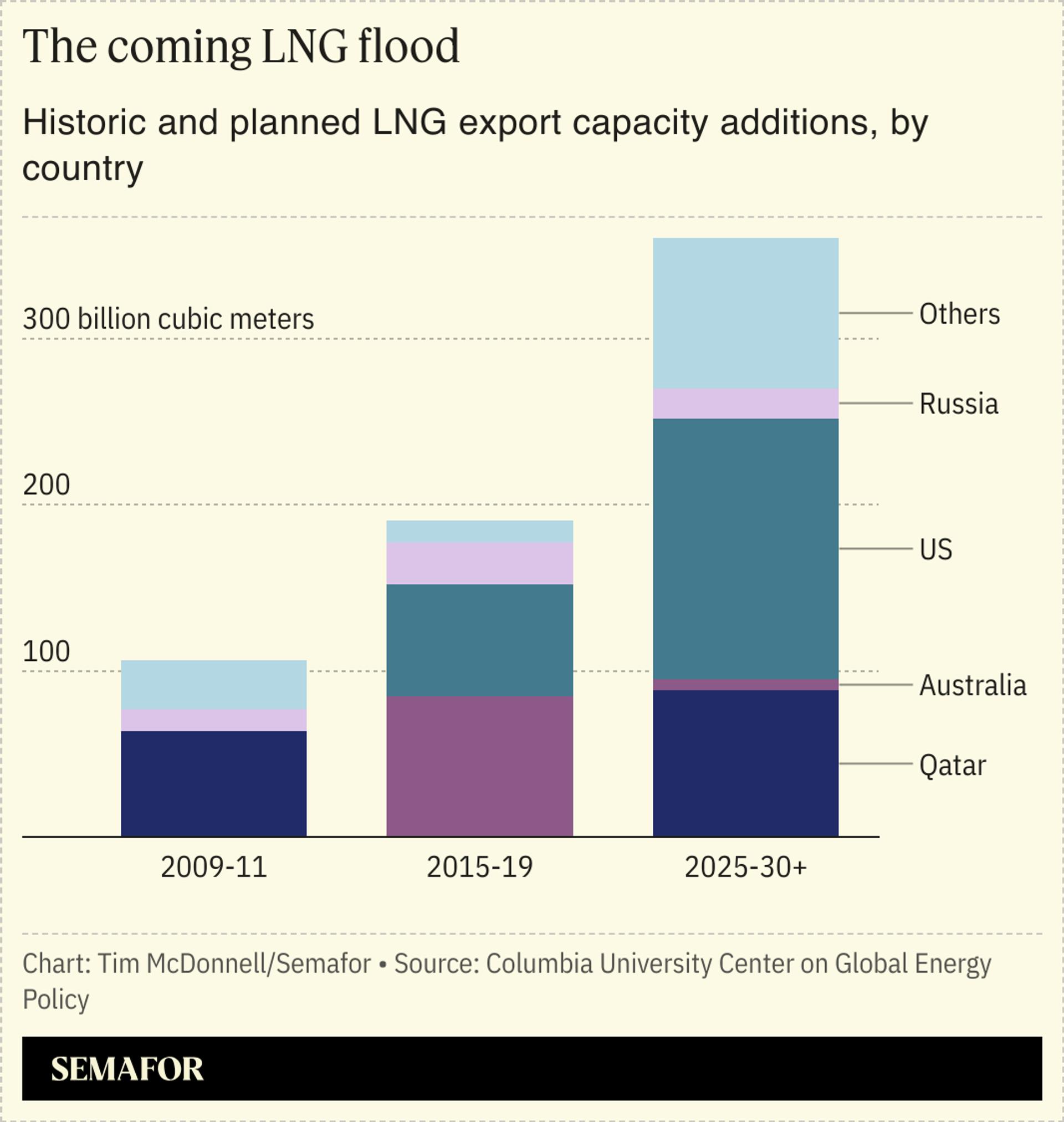

Global LNG export capacity is on track to grow 40% in the next five years, according to the International Energy Agency, with new projects popping up in the US, Qatar, Canada, West Africa, and elsewhere. Other potential projects are likely to take final investment decisions in the next 12 months. In the meantime, demand in Europe — a hotspot for LNG growth since Russia’s 2022 invasion of Ukraine — is leveling off. Renewables plus storage remain an ever-cheaper threat to gas-generated electrons. Uncertain economic growth in China, as well as the newly introduced wildcard of a potential massive new pipeline reaching there from Russia, are massive risk factors for future LNG investments since, as Columbia University’s Tatiana Mitrova wrote in the Financial Times last week, “expectations of growing Chinese demand underpin today’s LNG investment cycle.”

Put these factors together, and the second half of this decade looks ready to be awash in gas with no ready buyer.

“We’re just at the beginning of an unprecedented rise of new global gas supply,” Mike Fulwood, senior research fellow at the Oxford Institute for Energy Studies, told Semafor. “But in our view, demand won’t rise nearly as fast as supply. So the main question is, where is it all going to go?”

That question is especially urgent for oil and gas majors like ExxonMobil, Shell, and Total, which are investing heavily to position themselves as the chief conduits for seaborne gas and, in Fulwood’s view, stand to be squeezed the most by price downturns.

Gas prices have always been volatile, especially between seasons. But they are fluctuating more and more quickly than ever, according to the IEA. The pandemic and the Ukraine invasion were anomalies. But there are other factors at work, in addition to the infrastructure bottlenecks on Dell’Osso’s radar, that are causing a structural shift to greater gas price variability. A shift is underway from the long-term fixed pipeline delivery contracts that were the industry’s hallmark to more spot market trading and, accordingly, more speculation. There is increasing competition among fuel sources in the power sector that makes it harder to predict how much gas will really be needed in any given time and place. And there’s the impact of climate change itself, which disrupts seasonal temperature change routines. That volatility will leave US companies like Expand, and their investors, with some difficult choices ahead.

The View From Qatar

The choices that Qatar makes on gas in the next few years will be decisive for the global market’s strength or weakness, Columbia University researchers argue in a new paper today. Unlike the US, its main rival for the title of top global gas exporter, Qatar’s gas strategy is centrally coordinated. Faced with oversupply, QatarGas could decide to hold back some volumes — or push them on to the market at lower prices in a bid to incentivize demand and boost market share.

Room for Disagreement

For now, Dell’Osso remains bullish, and said he intends to stick to a previously announced plan to increase the company’s production from about 6.5 billion cubic feet per day last year to 7.5 billion this year. One factor that could help is a pair of announcements last week by Mitsubishi and Hitachi that they plan to ramp up manufacturing of gas turbines and related hardware, which will make it easier for the grid to soak up more gas. If gas prices have fallen a bit this year, Houston energy investor Dan Pickering wrote in a note last week, it’s actually a good thing: “Perversely, we are encouraged that expectations have been lowered/reset. It will just make for better momentum down the road.”

Notable

- Russia’s pipeline flirtation with China is nothing to worry about, Meg O’Neill of Woodside Energy said. The LNG supplier intends to forge ahead with a major new project in the US.

- The Russian pipeline proposal also shouldn’t become a distraction for the Trump administration in enforcing sanctions against Russian LNG projects, the Atlantic Council’s Olga Khakova wrote; Russia’s LNG expansion plans “remain the financial lever for aggression.”