The News

Japan — the world’s third-largest economy and fifth-largest greenhouse gas emitter — has begun implementing its version of the U.S.‘s Inflation Reduction Act (IRA). It may be a huge missed opportunity.

The Green Transformation Basic Policy, widely known as GX, aims to put Japan on a path towards meeting its 2050 net zero targets: The government plans to spend around 2 trillion yen ($14 billion) aimed at catalyzing 150 trillion yen, or about $1 trillion, of public-private investment into decarbonizing Japan’s energy, transport, and industrial sectors. It marks the latest in a string of efforts by countries worldwide that appear to be a direct response to the game-changing IRA, which has transformed the U.S.’s clean-energy push.

But critics are already worried Japan’s version could lead to the country wasting billions on infrastructure that does not reduce emissions, relies too heavily on unproven technologies rather than tried-and-tested ones, and compromises its energy security.

“Investing so much in these technologies that don’t have much climate impact is essentially greenwashing,” said Walter James, a Japan energy analyst and author of the Power Japan newsletter. “They’re bungling this opportunity.”

Nithin’s view

The GX ostensibly aims to create entirely new industries and make costly, unproven technologies scalable and affordable. Instead, it looks more like a paean to entrenched players and their commercial interests, rather than Japan’s.

For one, it focuses on increasing “zero-emission thermal power.” The idea is that by burning coal or natural gas in power plants with woody biomass, ammonia, or hydrogen, emissions can be reduced. Over time, the amount of alternative fuel can be increased, eventually eliminating coal.

In reality, this “co-firing” technology is still being piloted. Moreover, there isn’t an adequate supply chain for clean, green hydrogen or ammonia. And woody biomass — in Japan’s case, mostly wood pellets from the U.S., Canada, and Southeast Asia — is increasingly not seen as either climate or environmentally friendly.

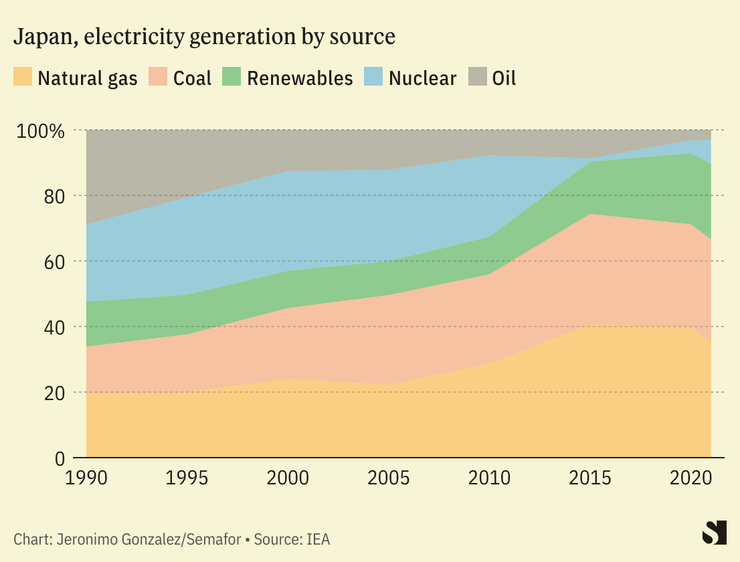

Another concern is the GX’s lack of ambition: By 2035, when other G-7 nations aim to have decarbonized most of their power sector, Japan will still rely on fossil fuels for more than half of its power generation.

When coal-rich regions like West Virginia or fossil-fuel powers such as Russia and Saudi Arabia push to maintain the primacy of fossil fuels, their efforts are often seen as an attempt to keep an industry, and those who benefit from it, alive. But Japan has to import nearly all of its energy. Why, then, is a country with so few energy resources not more willing to embrace renewables and increase its energy independence?

In reality, Japanese companies play a central role in fossil fuel extraction and financing around the world. Having built so many coal fired-power plants and LNG terminals both domestically and abroad, opponents of GX argue the reason the legislation is so fossil-fuel friendly is due to lobbying.

“Ambitious climate policy in Japan continues to be held back by powerful business groups representing heavy industry,” said Monica Nagashima, Japan country director for the nonprofit InfluenceMap, which this year published a report cataloging “intense and negative advocacy” over GX by a range of lobby groups including Keidanren, a business federation with over 1,400 corporate members, and trade associations representing high-polluting industries.

According to James, the energy analyst, environmental groups and scientific experts were mostly sidelined, a common problem in Japan, which often fails to take on board the recommendations of civil society and the general public in policy-making.

Teruyuki Ohno, executive director of the Tokyo-based Renewable Energy Institute, sees an economic risk to the GX, too. Japanese companies — notably Toyota — famously bet on hydrogen fuel-cell technology over battery electric vehicles, and have largely fallen behind competitors in the U.S., Europe, and China on next-generation automotive technology.

“If Japan’s energy policy continues to stick to fossil fuels, the carbon emission intensity of energy, including Japan’s electric power, will be locked in at a high level,” he said. “This will jeopardize the future of Japanese business, as Japanese companies will not be able to compete in the international marketplace.”

Room for Disagreement

Proponents argue the GX creates realistic pathways for Japan — limited by its dense population, geography, and unreliable wind and solar resources — to meet both its Paris Agreement and broader net zero commitments.

“The goal of the GX initiative is to realize a decarbonized society,” said Noriyuki Shikata, a spokesman for Japanese Prime Minister Fumio Kishida. “Japan will reduce emissions by 50 percent by 2030, utilizing existing nuclear power plants and replacing fossil-fired power generation with ammonia, hydrogen, and other zero-emission power generation.”

And the fact that green hydrogen supply chains or carbon-capture technology — both of which the GX relies heavily on — are still in their infancy is not a reason to assume they can’t play a role in decarbonization, argued Tatsuya Terazawa, formerly an official in Japan’s powerful Ministry of Energy, Trade, and Industry, and now CEO of the government-linked Institute of Energy Economics, Japan.

“Japan pioneered the supply chain for LNG,” he said, noting that the fuel’s first ever shipment was from Alaska to Japan in 1969. “For hydrogen and ammonia, we have to do it in a much shorter time, and that will require concerted efforts from government and industry.”

The View From Europe

Japanese energy prices have been relatively stable following Russia’s full-scale invasion of Ukraine. Not so in Europe. These differing experiences may explain the two places’ diverging reactions to the war from an energy point of view: Europe is accelerating efforts to shift away from fossil fuel imports, whereas Japan, which only received a small percentage of its LNG or petroleum imports from Russia, is focusing more on developing new oil and gas fields in places such as Papua New Guinea and Mozambique.

Notable

- The impact of the GX could be felt regionally. By promoting carbon capture, gas, and co-firing, Japan could single-handedly prolong fossil fuels across Southeast Asia, reports Climate Home News.

- Those costly technologies may not even be necessary. A recent report from BloombergNEF found that accelerating development of wind and solar power, as well as electric vehicles would be enough to meet Japan’s 2050 net zero goal while still maintaining its energy security, without any hydrogen or carbon capture. This effort would, however, require stringent carbon pricing, something not currently in the GX.