Amena’s view

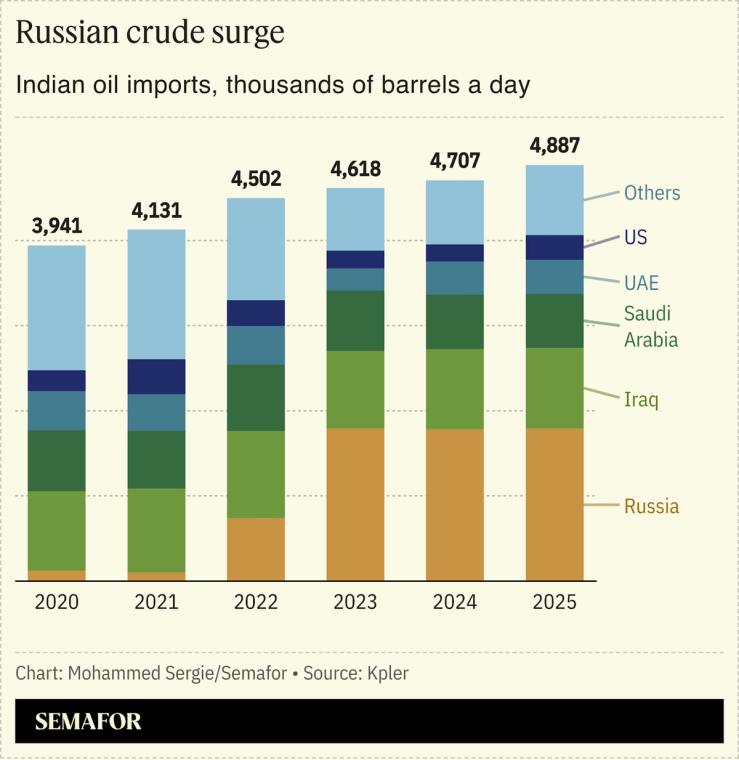

Tariffs or not, Washington should not expect New Delhi to abandon Russian oil overnight. India imports almost 40% of its oil from Russia, and its deep military and diplomatic ties with Moscow mean it has no quick or painless substitute to maintaining its relationship.

US President Donald Trump’s decision to slap a 50% tariff on Indian imports — coupled with social media posts and podium jabs accusing India of bankrolling Russia’s war in Ukraine — is aimed at cutting off Russian crude flows. While there are a few weeks until the measures take effect, providing a window for a compromise, Indian Prime Minister Narendra Modi has made his country’s position clear.

With a population of 1.4 billion, India depends on deeply discounted Russian barrels, importing around 1.7–2 million barrels per day (bpd). If those supplies were cut off, it would add $3–5 billion in annual import costs, according to Kpler, the independent data provider where I work. Losing Russian barrels may force India to subsidize fuel prices or reduce crude purchases, and the country has limited storage capacity to cushion against a supply disruption.

Private refiners more entangled in the US financial system, like Reliance, could look to Saudi Arabia, Iraq, or the UAE. But Middle Eastern producers have little incentive to slash prices, and shifting such large volumes would strain spare capacity already estimated at only 3.5 million bpd between Saudi Arabia and the UAE, according to Kpler.

If the 50% tariff holds and secondary sanctions follow, India might simply import less oil. Beijing could absorb some Russian supply, but it wouldn’t exceed 300,000 bpd, according to industry sources. Chinese refineries are optimized for heavier crude grades, leaving Moscow with few good options other than floating storage — an expensive but viable stopgap if the expected export disruption is temporary.

If an alternate customer isn’t found, pulling Russian barrels off the market would be bullish for prices which are hovering near $70 a barrel. Trump may tolerate oil prices, which benefit US shale producers, as long as gasoline prices at the pump don’t spike. For now, average US fuel prices are about 9% lower than a year ago.

Beyond oil, India’s strategic relationship with Moscow isn’t up for negotiation. Russia’s support during the 1971 Indo-Pakistan war — when Washington backed Islamabad — helped India win the war and cemented its ties with Moscow. Modi spoke to Russian President Vladimir Putin last week, and for now, India has paused planned purchases of US weapons.

It’s unclear where the tariffs will settle and what will happen to discounted Russian crude, but there’s an expectation of a compromise. What is clear is that India’s oil lifeline from Russia and deep ties will not be severed easily, no matter how hard Washington pushes.

Amena Bakr is the Head of Middle East Energy & OPEC+ research at Kpler, an independent global commodities trade intelligence company.

Notable

- Reliance Industries, the conglomerate owned by Asia’s richest man Mukesh Ambani, is among the top buyers of discounted Russian crude. Indian refiners may see lower profits but are prepared to switch to other sources, The New York Times reported.

- Why is New Delhi resisting Washington’s pressure? The Wall Street Journal explains that India’s ties with Moscow have brought both economic and geopolitical benefits.