The top two US oil companies are planning their next moves following their years-long legal battle.

ExxonMobil and Chevron each reported on Friday that second-quarter profits fell by about $2 billion compared with the same period last year, thanks to weak oil prices. But after an arbitration court ruled last month in Chevron’s favor over its contested acquisition of Hess, the mammoth firms are feeling upbeat.

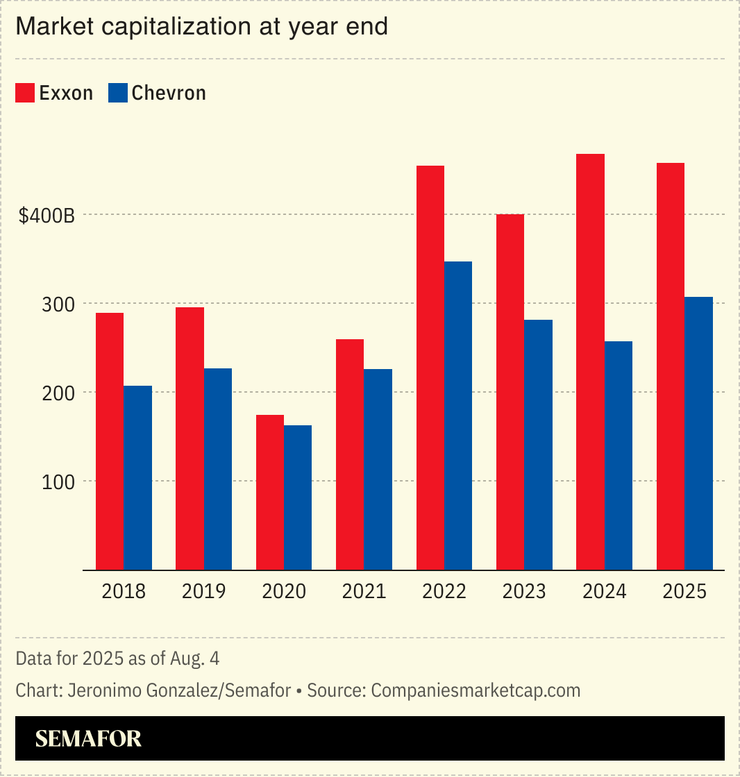

Exxon CEO Darren Woods said he expects global oil demand to stay “very, very strong” in spite of the latest round of US tariffs, and told The Wall Street Journal he is actively targeting new acquisitions. Chevron CEO Mike Wirth, meanwhile, is coming out of the Hess debacle with a renewed appetite for corporate combat, making deep cuts to staff numbers and pushing for an internal culture overhaul to hold employees to tougher standards, aiming to bring Chevron’s share price back up to par with Exxon’s.

Across the pond, the outlook for BP is decidedly mixed: The British major reported its biggest oil and gas discovery in 25 years, but warned on Tuesday that, under pressure from activist investors, it is searching for deep cost cuts and may sell off more assets.