The Scoop

Saudi Arabia’s biggest pension fund is preparing to overhaul its senior management team after a wave of executive departures, according to three people familiar with the matter.

Hassana Investment Co., which has more than $320 billion in assets under management, appointed Chief Investment Officer Hani Al-Jehani as acting CEO following the July 1 departure of Saad Alfadly, who led the firm for 12 years. The board is still looking for a permanent replacement almost six months after Alfadly announced his resignation, and Al-Jehani is among several candidates in the running, the people said.

Once a new chief executive is appointed, the fund is expected to reorganize its leadership team to fill the gaps left by the recent exits. Hassana declined to comment.

In this article:

Know More

Hassana — established in 2009 as the investment arm of the General Organization for Social Insurance — has grown steadily under a stable management team. But several senior executives have left since Alfadly announced he would step down and join the fund’s board.

Last month, senior adviser Paul Sweeting and chief risk officer Maram Alnumay departed. In May, chief investment officer for regional markets Ahmed Alqahtani and head of local public equity Ahmed Alhumaidan also left. Chief strategy officer Hamza Khushaim and general counsel Shaima Bakhsh are expected to depart by the end of August, the people said.

Matthew’s view

The leadership changes come as Hassana has taken on a more expansive role with global asset managers and international investments. It’s helping attract foreign managers to the kingdom, a key part of plans to develop the country’s financial system and fuel its economic diversification.

Hassana is serving as an anchor investor in joint ventures being set up in the kingdom by Brookfield Asset Management and State Street Global Advisors, and has written big checks to back TPG’s climate fund and other international vehicles. Its investment portfolio has expanded significantly in both size and geographic footprint since its early focus on Saudi equities and real estate.

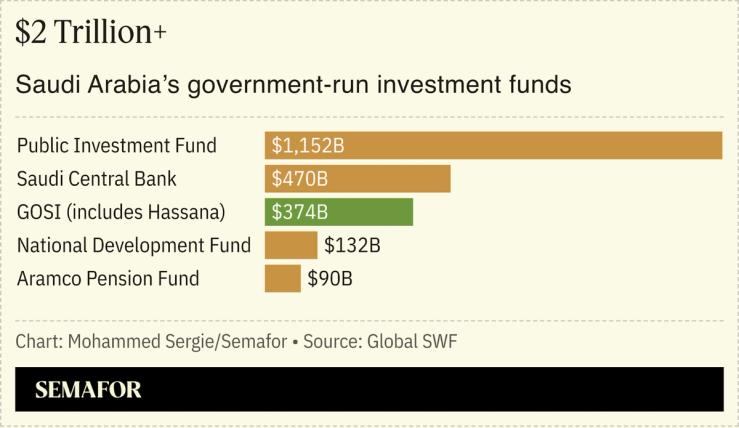

While management changes are not uncommon, a shake-up of this magnitude at a Gulf investment institution is rare and could signal a strategic shift. Since its 2021 merger with the Public Pension Agency, Hassana has grown in prominence and now manages the vast majority of retirement savings for Saudi citizens, making its performance key to the kingdom’s social security system.

Notable

- Hassana broke into the ranks of the world’s top 10 pension funds in 2023 after absorbing the Public Pension Agency and now serves more than 10 million members, a feat industry tracker Global SWF described as “incredible.”

- There have been significant leadership changes across the Gulf’s sovereign wealth funds over the past six months. This Bloomberg article profiles the key figures overseeing the region’s $4 trillion in capital.