Chevron prevailed in the oil industry’s biggest legal showdown in a generation — but still faces the challenge of regaining investors’ confidence and operating a new oil field in partnership with its chief rival.

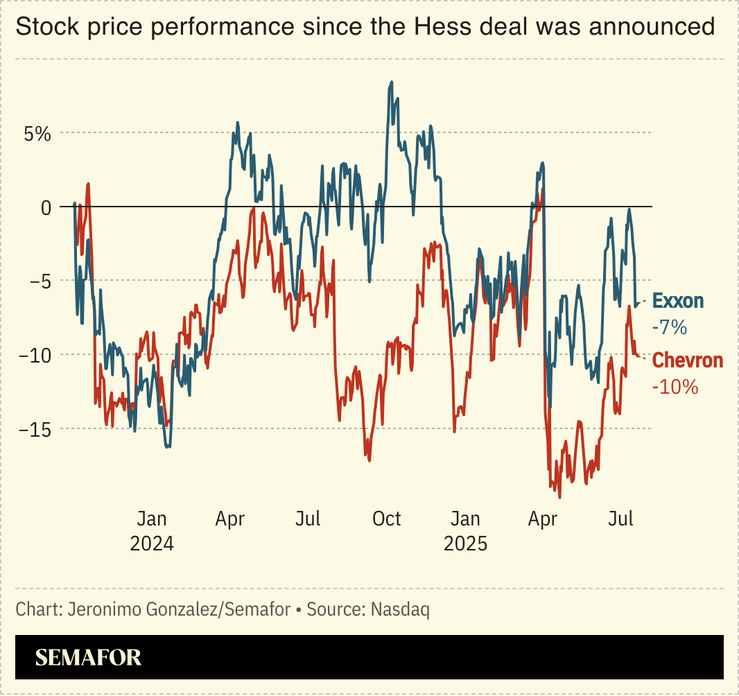

An arbitration court in Paris ruled that Chevron could proceed with its $53 billion acquisition of Hess, which had been on hold since 2023 as ExxonMobil contested the deal on the grounds that it had first dibs on Hess’s share in a vast, lucrative offshore field in Guyana. It was a much-needed win for Chevron, which had seen its share price dragged below most of its peers as it confronted not just the Guyana case but also difficulties with its operations in Texas, Venezuela, and Kazakhstan.

Exxon might have lost, but as Javier Blas writes in Bloomberg, its delay tactic was successful in putting Chevron CEO Mike Wirth on the defensive for two years and giving Exxon shares a decisive advantage on Wall Street. Exxon remains a partner in the Guyana project, meaning both companies must now put hard feelings aside and get to work on drilling together — at a time when weak oil prices are making the economics of big offshore projects more challenging than they’ve been since the pandemic.