Saudi Arabia further widened the franchise of who can invest in its stock market. Gulf residents will now be able to trade directly in the Tadawul, and expats will retain access to their investment accounts rather than being forced to shut them down when they leave the country.

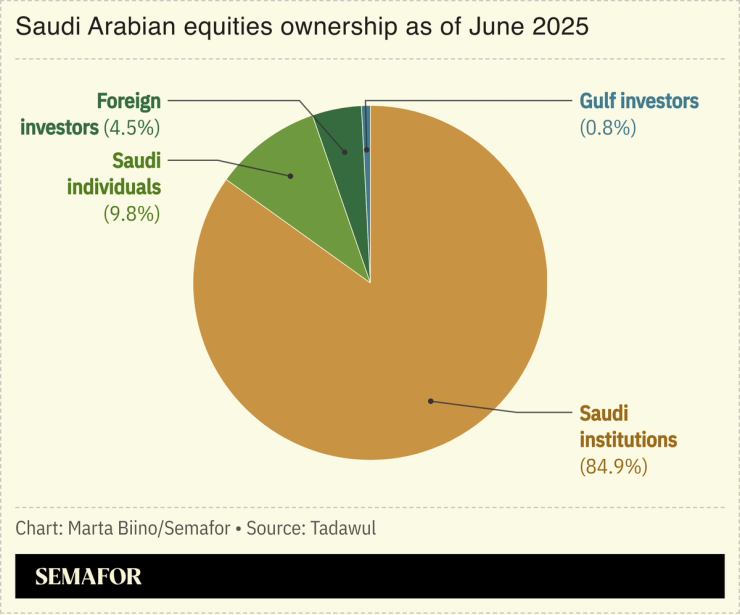

Just over a decade on from opening the Tadawul to foreign institutions, Saudi Arabia has kept tweaking the exchange’s rules in a bid to bring in more foreign capital and boost liquidity. While the market has attracted new investors, many emerging market fund managers still ignore the country. Typically, they say two things hold them back: Valuations are too rich and liquidity isn’t high enough for them to quickly build up or sell off positions.

There’s little the exchange can do about high valuations, but widening access could (modestly) help boost liquidity.