The Scoop

One of the biggest rooftop solar installers in the US, Freedom Forever, may be forced to “shrink back to the size of a mom and pop” if Congress approves a Republican plan to eliminate the tax credit that shaves up to 30% off the cost of household solar systems, a company’s executive warned.

Plans to kill the tax credit by the end of the year would be tantamount to a death sentence for much of the residential solar industry and bring major layoffs, Ben Airth, policy director at Freedom Forever, told Semafor. The Senate is expected to vote on the “One Big Beautiful Bill” as soon as this week, legislation that would scale back many tax benefits for clean energy, but hit rooftop solar especially hard. Analysts project that the measure would cause the amount of rooftop solar installed in the US to fall in 2026 by more than half compared with its 2024 level.

“We’re in such limbo right now, and limbo is costing us jobs,” Airth said. “The industry will contract back to where it was in 2005.”

In this article:

Tim’s view

The US residential solar industry was already in a tough place before its tax credits came under fire. Installations in 2024 fell 31% compared with the previous year, largely due to high interest rates. Two of the industry’s biggest companies filed for bankruptcy this month, and all have taken a big hit to their share prices. If the tax credit elimination becomes law, those troubles are far from over — and the companies that survive will need to drastically adjust their business models.

The last year had actually been quite a good one for Freedom Forever, which is privately owned, with monthly sales hitting all-time highs as it expanded into new states, Airth said. In 2024 it commanded 7% of the US market, up from 5% the previous year, making it the country’s number-two rooftop installer after Sunrun, according to research firm Wood Mackenzie.

All that growth is now at risk, Airth said. If the tax credit disappears, the degree of pain for solar installers will depend largely on how Wall Street views the industry’s prospects, he said. Most installers require large injections of capital upfront to pay for hardware that their customers pay off over time. If that capital becomes more expensive just as customers lose their 30% tax bonus, many rooftop solar systems will fail to deliver the year-one savings over conventional grid power that Airth said are an essential selling point.

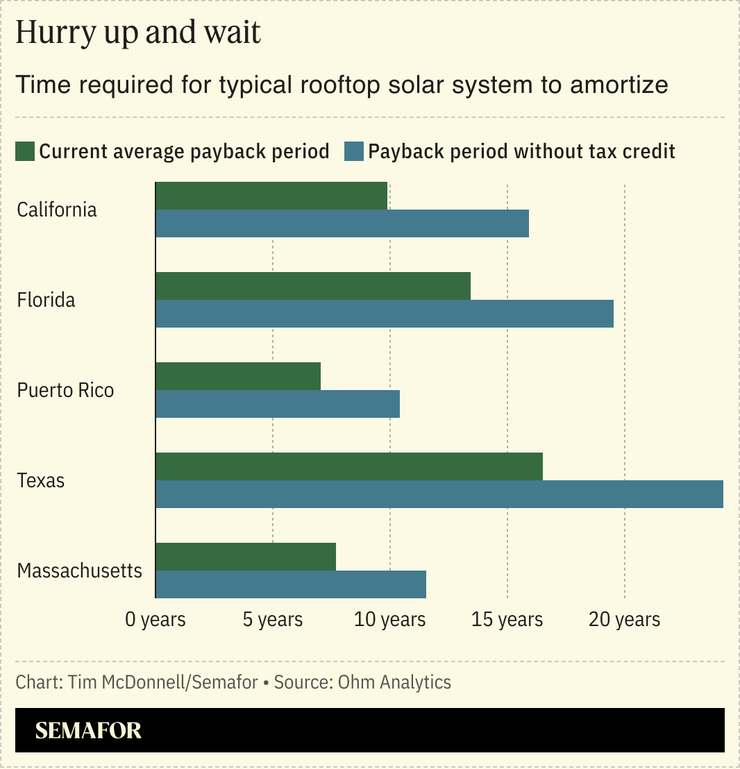

The situation will differ across the country, he noted. States that allow homeowners to either lease rooftop solar systems, or to buy power on a contract from a commercial-scale solar farm, may have financing options other than direct system sales that are still viable without the tax credit. And in states where grid power is expensive — California, for example — solar could still pencil out for homeowners without the tax credit. But in a place like Washington state, for example, where power is cheap and residential power purchase agreements aren’t allowed, “that market is done,” Airth said. “Florida, too, could disappear overnight.” And in Florida, for one, Freedom Forever employs nearly 500 people.

As a result, Freedom Forever’s survival strategy will be to home in on only the most attractive markets, he said. In an extreme scenario, that could eventually lead to pulling back to one of rooftop solar’s original comfort zones, the San Francisco Bay Area, where power prices are high and green sentiment runs deep. To prevent that scenario, Airth said, the industry needs Congress to give it a longer runway to hunt for cost savings before yanking the tax credit, and for state-level policymakers to clear away more red tape.

Know More

The rooftop solar tax credit, as it currently exists, doesn’t require homeowners to buy domestically manufactured solar panels. But removing the credit would deal a devastating blow to the nascent manufacturing industry, which is already barely able to keep its prices competitive with exporters in Asia, said Emily Walker, director of insights at the online solar marketplace EnergySage.

Room for Disagreement

“US rooftop solar is not doomed,” said Jenny Chase, solar analyst at BloombergNEF. “Rooftop solar is still being deployed in countries with much worse economics than the US post-tax credit.” But the US industry may change to look more like it does in other countries, with far fewer big corporate installers that have high overheads related to marketing and financing. Those kinds of companies — like Sunnova, one of this month’s bankruptcies — may not be able to survive in the new market.

Notable

- China shattered its record for solar installations for a single month, adding 93 gigawatts of capacity in May. That’s more than any other nation managed in all of 2024, as well as beating China’s own December record of 71 gigawatts.