As the artificial intelligence battle between the US and China intensifies, one of the world’s wealthiest oil exporters aims to capitalize on the race and reap the benefits of delivering the energy required to power the AI revolution.

Despite concerns this week over the escalating war between Israel and Iran, a high-level delegation from Abu Dhabi flew out to Washington to press its position and advance its AI ambitions.

Abu Dhabi’s strategy is aligned with a top US priority: maintaining an edge in AI over China. The two countries remain the only ones capable of building AI at scale. Whoever wins won’t just dominate a new industry — they will gain an advantage with far-reaching economic, technological, and national security ramifications.

At the Energy in Action Majlis — a high-level gathering of senior US officials and executives from the energy and tech sectors, known as ENACT — Sultan Al Jaber, CEO of ADNOC, led discussions on how to realize this future, sidestepping the immediate uncertainty facing the Gulf hydrocarbon lifeblood.

“The AI-energy nexus is not tomorrow’s issue. It’s today’s imperative,” said Al Jaber, who also serves as the UAE’s Minister of Industry and Advanced Technology.

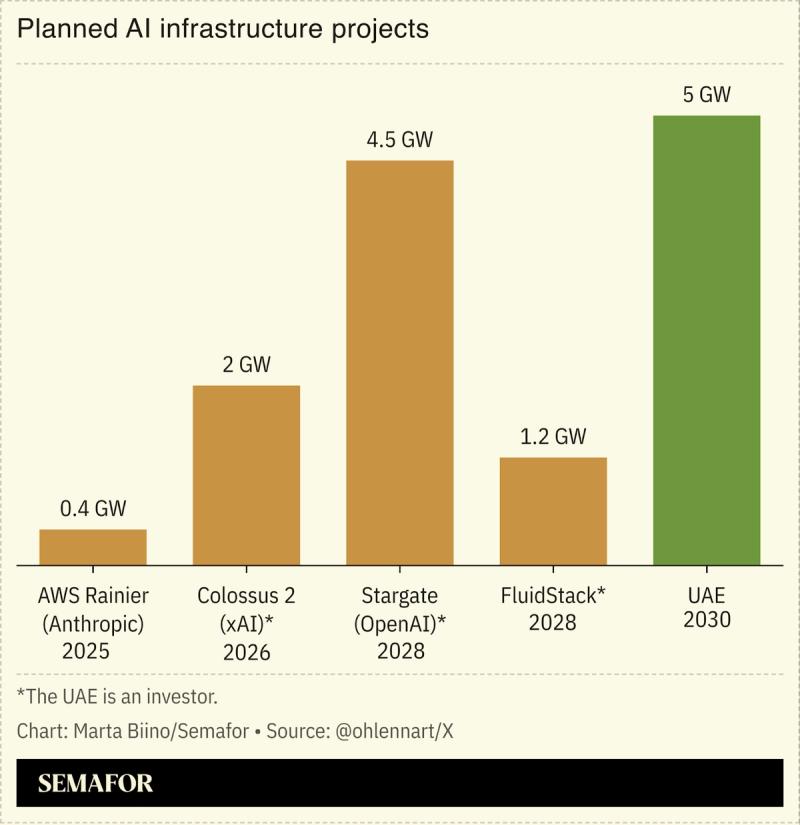

AI’s demand for power is massive: Data centers are set to triple over the next five years, with a third of them expected to be built in the US. That will require an additional 50 to 150 gigawatts of power capacity by 2030 — the equivalent of adding three to ten New York Cities to the grid, Al Jaber said.

Energy producers are increasingly optimistic about the demand from the power-hungry tech sector. The UAE, along with other Gulf states, is advocating for a pragmatic approach to energy by investing in all sources: upstream oil and gas, solar, wind, and nuclear. While some Western nations have curbed energy investments in recent years, the Trump administration is signaling a shift, with a renewed focus on “making more energy” and “building big things.”

Al Jaber urged that the pace of progress must match the scale of the challenge. “The world is rushing into the age of AI with a 20th-century grid, 19th-century permitting systems, and 18th-century policies,” he said. “We need a modern integrated response across infrastructure, policy, and investment.”

For its part, the UAE is investing heavily at home and abroad to build out energy and AI infrastructure. ADNOC’s recently launched international investment arm, XRG, and renewable energy firm Masdar, plan to grow investments from $70 billion to $440 billion by 2035, according to Al Jaber.

One participant at ENACT offered a metaphor that AI and energy are as intertwined as a human’s blood flow and brain. Both must move in tandem. Both can also enhance each other, with AI boosting and optimizing energy output, and energy fueling innovation.

As the world focuses on missile barrages and air strikes this week, the greater prize lies with who will control the technology and infrastructure that will shape the global economy for decades. While the race to build the most powerful AI models continues, Gulf states are positioning themselves to be the ones who keep them powered.

Amena Bakr is the Head of Middle East Energy & OPEC+ research at Kpler, an independent global commodities trade intelligence company.