The News

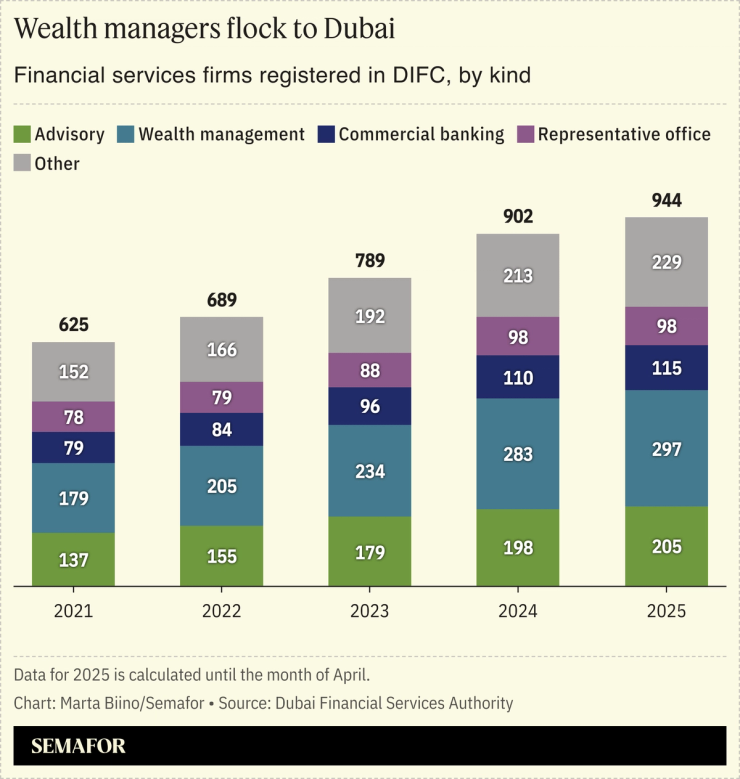

Wealth managers are driving a 20% rise in the number of financial services firms setting up shop at Dubai International Financial Center since the start of 2024, as the hub extends its lead over rivals in Abu Dhabi, Doha, and Riyadh in attracting global financiers.

The DIFC’s pitch to firms: Dubai has become a playground for the global rich, a spokesperson said while revealing the data this week. While Abu Dhabi is home to most of the country’s sovereign wealth, Dubai has tens of thousands of high-net-worth individuals, characteristics that are helping the country’s aims to become a top financial center.

Know More

Dubai, the UAE’s largest city, has seen its millionaire population double in the last decade, making it one of the fastest-growing places for wealth attraction in the world, according to London-based residence advisory firm Henley & Partners.

As the wealth management industry becomes saturated, the DIFC is now looking to expand its roster of financial technology firms and investment banks. Part of its growth strategy is to allow companies to experiment with new financial tools in a controlled environment. Its latest initiative: a regulatory sandbox for asset tokenization.

“We see broad potential of tokenization across the financial ecosystem,” said Charlotte Robins, a managing director at the Dubai Financial Services Authority (DSFA). “By working closely with local and global firms through the sandbox, we are encouraging responsible innovation and helping to ensure that new ideas are tested against regulatory expectations.”

So far, the effort has attracted nearly 100 applications from firms in the US, UK, and Singapore, with proposals to tokenize shares and bonds, including Islamic bonds, or sukuk, according to the DFSA.

Notable

- The “capital of capital” title goes to Abu Dhabi, with $1.7 trillion in sovereign wealth under management and growing.

- Lower oil prices and weakened finances in Saudi Arabia are leading some bankers to rethink Riyadh, Bloomberg reported.