The News

The world will probably use a lot less hydrogen in the next few decades than Big Oil would like you to think — and that could cut deeply into their future profits.

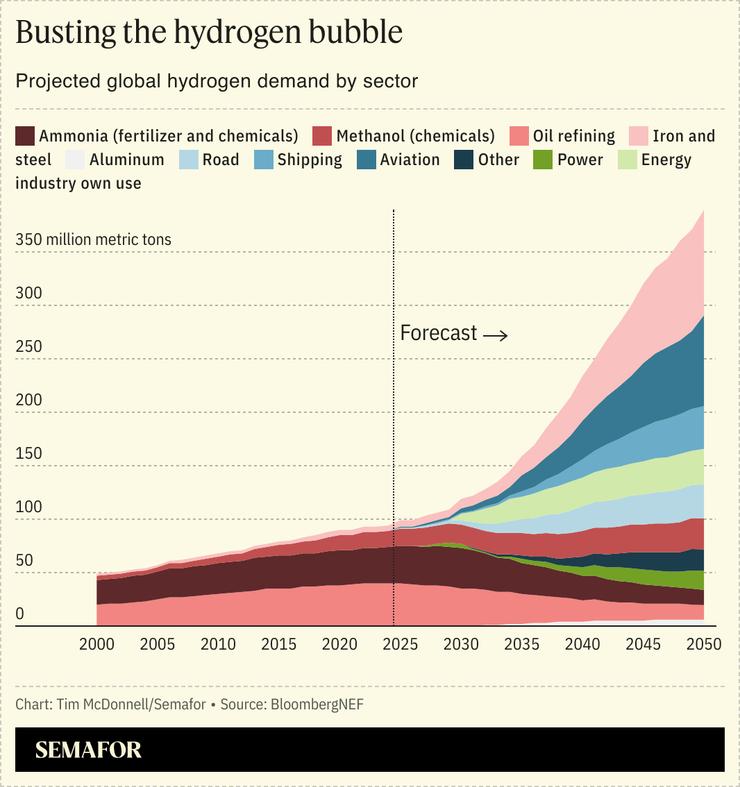

That’s one of the biggest takeaways from an in-depth forecast of the energy transition this week by BloombergNEF. By 2050, the report projects, if the global economy is on track for net zero, the world will need about 390 million metric tons of hydrogen annually. That’s about 25% less than the total demand that BNEF projected in the same report last year — and about half of what the main hydrogen lobbying group, whose members include the oil majors and energy services companies like Baker Hughes, hopes to see.

The main reason for the steep cut is that BNEF decided to essentially disqualify hydrogen from any role in decarbonizing commercial or residential buildings, because doing so will likely never be cheaper or easier than other options, like electric heat pumps. BNEF also dropped hydrogen as a possible low-carbon fuel for trains, and cut its expectations for how much will be needed for power and other sectors.

As renewables, batteries, carbon capture, and other climate tech get cheaper, BNEF’s head of energy economics Matthias Kimmel said, the need for hydrogen is diminishing.

Tim’s view

If BNEF is right, legacy energy companies betting that they’ll be able to pivot much of their existing natural gas business to hydrogen could be in jeopardy.

A world that needs a lot of hydrogen — one where it’s a low-carbon “Swiss Army knife” that can replace fossil fuels in everything from semi-trucks and airplanes to apartment buildings and steel factories — is good for the oil and gas industry, which is already in the business of producing and transporting molecules.

Hydrogen is typically described with a rainbow of colors to denote how it was produced: Gray hydrogen is made with natural gas, blue with gas and carbon capture, green via renewables. Until more renewables-based hydrogen becomes available, fossil-based hydrogen will remain the predominant source.

Oil companies have thus been leading the charge to get the Biden administration to adopt lower qualification barriers for hydrogen tax credits — a windfall potentially worth hundreds of billions of taxpayer dollars — on the grounds that some flexibility on how the fuel’s carbon footprint gets measured is justified by the need to scale up production as quickly as possible to serve massive looming global demand.

A bullish outlook for long-term hydrogen demand, in other words, means more near-term money in oil companies’ pockets.

Conversely, a world that doesn’t actually want much hydrogen is one with less need for today’s oil and gas companies, and one where strict tax credit guidelines are more justified. Data indicates that that’s the world we’re headed for. Whereas the Hydrogen Council trade group envisions hydrogen providing 22% of total global energy in 2050, BNEF projects it will be just 9%. A separate study by US energy researchers concluded the share could be as low as 3%. This month, the UK government scrapped a pilot project to use hydrogen for home heating because it was more expensive compared to heat pumps. And a review last year by former BNEF head Michael Liebreich — a vocal critic of bullish hydrogen forecasts — downgraded the likely viability of hydrogen for power exports, mining trucks, utility-scale batteries, and other sectors, concluding that “in the majority of cases there are cheaper, safer and more convenient zero-carbon alternatives” to hydrogen. In this week’s BNEF forecast, hydrogen is seen to play no role in decarbonizing cement or petrochemical production, buildings, or trains.

The future of hydrogen-equipped homes envisioned by the movie Glass Onion will probably never happen, Kimmel said, because all the infrastructure that would be needed to deliver it would be far costlier than just building more renewable electricity capacity. The first generation of low-carbon hydrogen projects have proven to be more expensive and slower to develop than analysts expected. Green hydrogen remains about 27 times more expensive per megawatt-hour than natural gas, and more than twice as expensive as gray hydrogen. The government subsidies that exist aren’t enough to cover the gap, which has left hydrogen with few interested buyers and stalled out investment in more production.

What’s more, the net zero scenario described in the BNEF report is the group’s most optimistic option for hydrogen adoption. If the energy transition proceeds more slowly, hydrogen demand will be significantly lower.

Room for Disagreement

The bearish-on-hydrogen camp is in agreement that it will definitely be needed and cost-effective for some sectors, especially steel and aviation fuel, where electrification isn’t viable. That’s a tricky needle for investors to thread: The hydrogen producers and distributors able to lock in solid customers early will make a killing; anyone late to the game will get shut out.

Know More

The good news in the BNEF report is that the overall cost of the transition falls as technology gets cheaper. Getting to net zero by 2050 will cost about $215 trillion, the report finds. That’s not chump change, but it’s only about 5% of projected global GDP in that year. And it’s only about 19% more than BNEF’s base case, i.e., what total energy investment would likely be if economics, not emissions, were the main determinant of investment. That gap is growing smaller every year, Kimmel said — even though every year we delay a more aggressive transition, the cost to reach net zero by 2050 goes up.

The View From Chile

Unpredictable future demand for hydrogen isn’t holding back all investors: Last week the Japanese oil refiner Idemitsu Kosan bought a $114 million stake in HIF Global, which is developing synthetic liquid fuels using green hydrogen made with wind power in Chile. Hydrogen is a cornerstone of the company’s net zero strategy, executives said.