Mubadala has ridden waves of private credit and artificial intelligence to notch some of the highest returns of any sovereign wealth fund in the world.

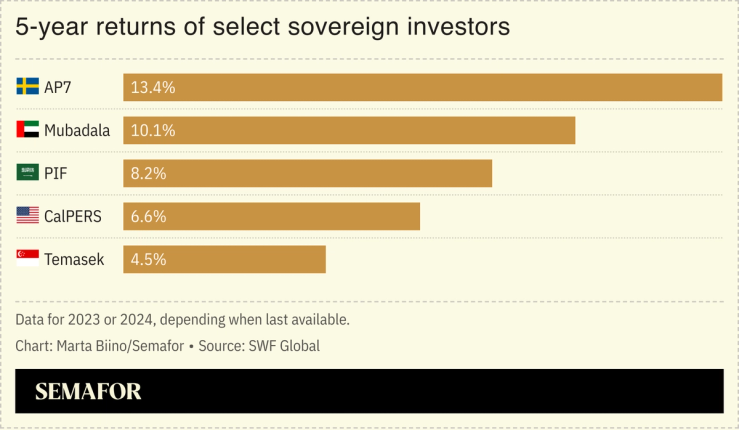

Assets under management grew to $330 billion for Abu Dhabi’s second-largest fund, up 9.1% from the previous year, according to its annual report, while it reported a five-year rate of return of 10.1%, outperforming all other sovereign investors, according to figures from Global SWF.

Private credit was the best-performing asset class for a third year in a row — and its allocation rose to about $20 billion in 2024 through investments with US firms Apollo, Ares, Carlyle, Goldman Sachs, and KKR, according to a statement.

Mubadala is also investing aggressively in AI as a founding partner of technology fund MGX — alongside Abu Dhabi’s AI firm G42 — which has a target of $100 billion in assets. Last year MGX joined BlackRock and Microsoft in a $30 billion effort to bankroll data centers and energy infrastructure, primarily in the US. MGX has also backed the $100 billion Stargate initiative announced by the Trump administration — alongside OpenAI, SoftBank, and Oracle — to fund AI infrastructure.