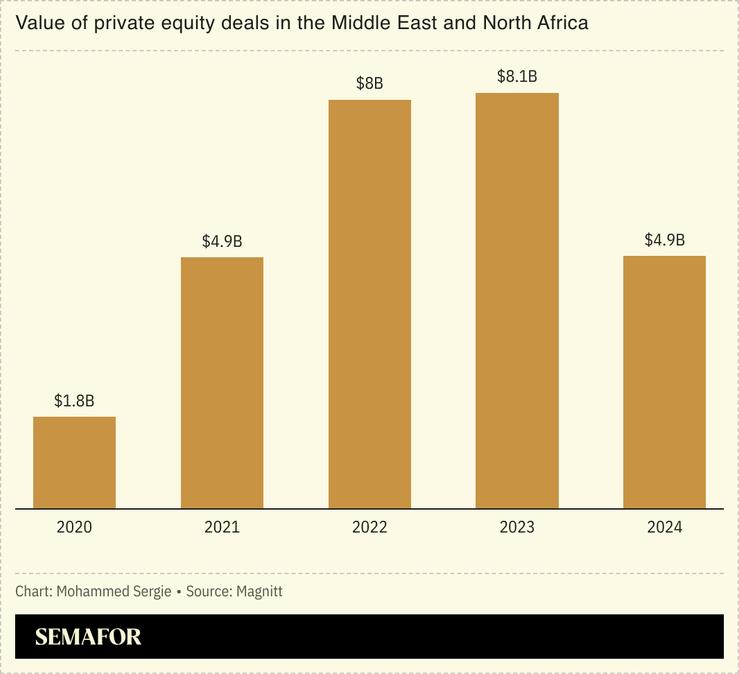

Private equity deals in the Middle East and Africa fell to a three-year low in 2024, reflecting a global slowdown in the asset class.

Tighter credit conditions and valuation mismatches hampered the execution of deals, according to a report by data analytics firm Magnitt. While the UAE has historically led the region in deal activity, Saudi Arabia has taken the top spot over the past two years and is expected to expand its lead further as it ramps up local investments to diversify its economy.

Globally, private equity assets under management declined in 2024 for the first time since Bain & Co. began tracking the asset class in 2005, and the consultancy expects continued pressure for up to four years. In this region, Magnitt predicts a rebound in 2025, driven by sovereign wealth funds — led by Saudi’s Public Investment Fund and Abu Dhabi’s ADQ.