The Saudi property market has rebounded after four years of decline, but soaring prices and high interest rates are locking out many locals, especially renters.

Residential sales jumped 38% last year, reaching 165 billion riyals ($44 billion) — the highest level since 2015, according to real estate consultancy Knight Frank. Broader homeownership ambitions, however, are fading: In 2022, 84% of renters planned to buy within a year; by 2024, that figure had dropped to 29%.

The market faces a mismatch, with a glut of luxury properties but a shortage of affordable homes and rentals.

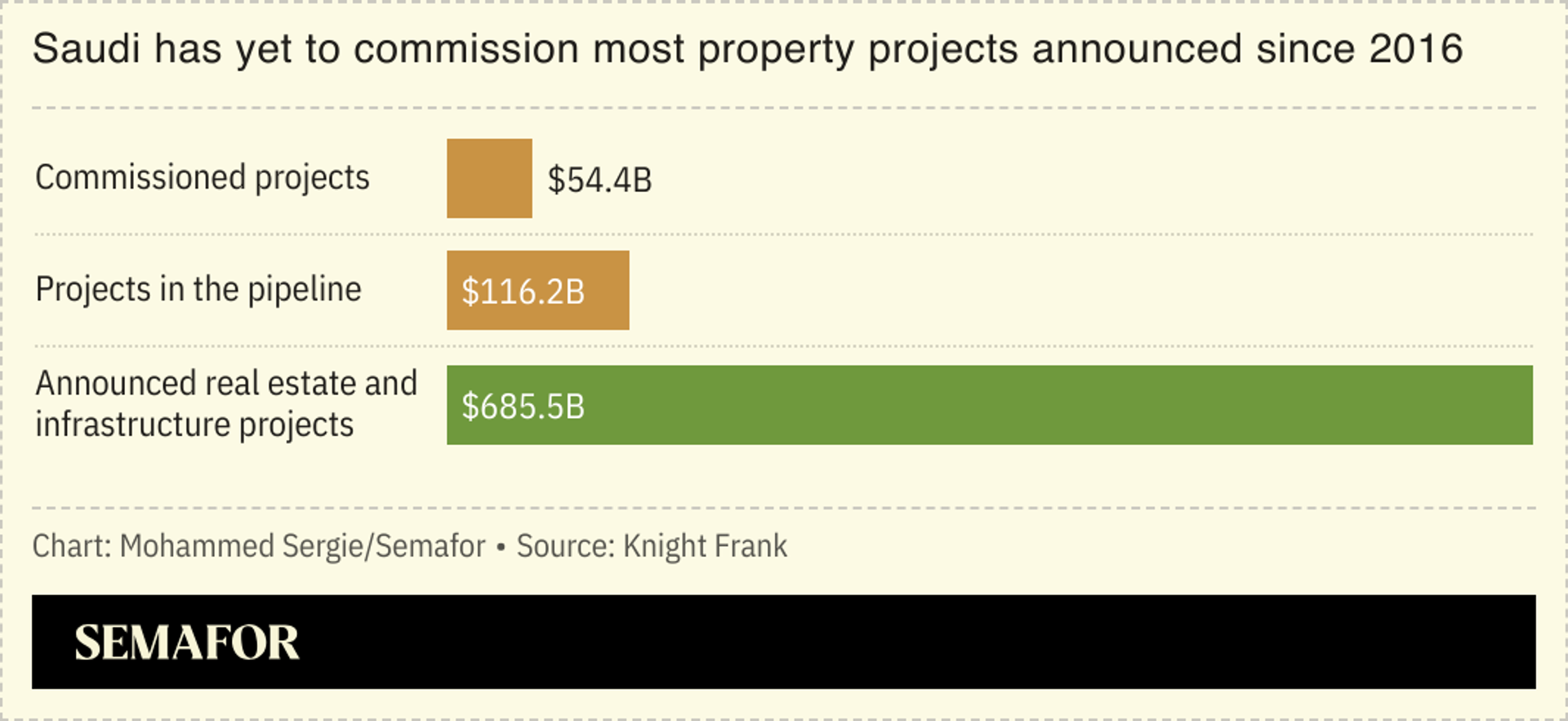

The kingdom’s construction sector will become the world’s largest by 2028. “We’re not building the product to match the demand,” Knight Frank’s Faisal Durrani told Bloomberg. Saudi Arabia aims for 70% homeownership by 2030, but to get there, it will need to ramp up supply through its giga-projects — including NEOM, Roshn Group developments, Jeddah Central, and Riyadh’s King Salman Park — which are in high demand by Saudis.