The News

Warren Buffett’s new letter to Berkshire Hathaway shareholders offers a window into the storied investor’s outlook on the energy transition — projecting a long, bright future for U.S. fossil fuels.

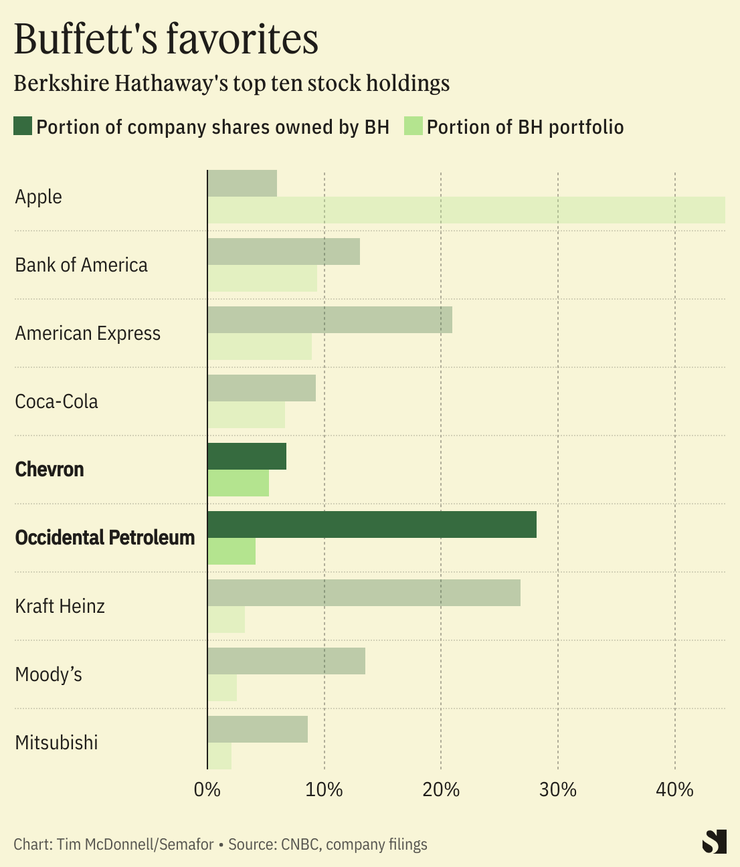

The letter singles out Occidental Petroleum, of which Berkshire owns 27.8%, for special praise, saying the company is “doing the right things for both its country and its owners” by helping to free the U.S. from reliance on imported oil. Berkshire intends to hold stock in the company “indefinitely,” Buffett writes, elevating Occidental to the level of the “truly wonderful businesses” Coca-Cola and American Express.

“No one knows what oil prices will do over the next month, year, or decade,” Buffett writes. “But [Occidental CEO] Vicki [Hollub] does know how to separate oil from rock, and that’s an uncommon talent, valuable to her shareholders and to her country.”

Tim’s view

Energy security has long been a focal point for Buffett, and Berkshire’s holdings across the sector show a vision of the clean energy transition unfolding slower than what climate activists would like to see. Buffett is willing to stake out early positions on promising climate technologies — he backed Chinese automaker BYD in 2008 before it had even announced its first plug-in hybrid, and his letter also praises Occidental for its leadership among Big Oil peers on carbon capture. Berkshire’s subsidiary Berkshire Hathaway Energy (BHE) is also one of the country’s largest owners of wind and solar farms.

But Buffett evinces an old-school preoccupation with U.S. energy independence and sees no end in sight for natural gas. Berkshire is one of the few insurers that has not yet set a target to wind down emissions from its insurance and investment portfolios. The problem with Buffett’s all-of-the-above energy transition strategy is that — as some shareholders have complained, and as his letter this weekend itself articulates — the carbon-intensive companies in the portfolio put the value of other holdings that are exposed to climate impacts at risk.

“There isn’t a holistic approach across the company for addressing climate risk and opportunity,” said Dan Bakal, senior climate and energy director at the sustainable investment advocacy group Ceres, which has supported climate-related shareholder resolutions at Berkshire Hathaway. “There could be some very considerable disconnects on the level of risk they face.”

Buffett’s endorsement of Occidental focuses on the oil market, but it’s clear that he is preparing for a global economy in which oil’s preeminence is replaced by natural gas, Rob Thummel, managing director at the energy-focused investment firm Tortoise told me. Two-thirds of BHE’s assets are gas infrastructure, including two of the country’s largest interstate gas pipelines. It also last year became the majority owner of Maryland’s Cove Point liquified natural gas export terminal, locking in a lucrative piece of the global LNG trade before the Biden administration threw the brakes on that industry last month. Even Occidental’s strategy for the energy transition — to dominate the market for carbon capture and storage (CCS) — implies a long-term market for gas; if gas-burning power plants and factories all switched to clean electricity there would be no need for CCS.

Occidental also meets several of Buffett’s other traditional prerequisites, said Todd Finkle, a professor of entrepreneurship at Gonzaga University and a Buffett biographer. It’s the largest oil producer in Texas, with a commanding position in the Permian shale basin and the efficiency of scale to have a promising future of cash flow from its existing assets, even if the price of oil tilts down over time. The company’s embrace of CCS gives it a moat in scaling up that technology that other companies will struggle to cross. It also demonstrates a savvy use of government subsidies, namely the Inflation Reduction Act’s 45Q tax credit for carbon capture: China’s lavish subsidies for EVs were a major draw for Buffett’s BYD investment. And, as his letter makes clear, he just likes Hollub — confidence in individual managers is a classic Buffett draw.

Know More

Buffett, however, admits the electric utility division of BHE presented the company’s most “severe earnings disappointment,” largely because of half of a billion dollars in settlements it was forced to pay in lawsuits from homeowners and timber companies resulting from devastating wildfires in Oregon in 2020. BHE also disclosed on Monday that the U.S. is seeking to recoup more than $1 billion in additional firefighting and cleanup costs from those fires. In his letter, Buffett complains that state-level grid regulators have put the company in a bind by not allowing it to raise power prices sufficiently to cover the costs of climate-adaptive grid upgrades, such as burying transmission lines underground. That has shaken his conviction in utilities as “among the most stable industries in America,” especially as the costs of building out the grid for higher electricity demand, and rebuilding it after disasters, are likely to increase: “When the dust settles, America’s power needs and the consequent capital expenditure will be staggering.”

That’s precisely the type of risk that some Berkshire shareholders want the company to publicly reckon with. Utilities aren’t the only holdings at risk — even Buffett’s beloved Coca-Cola and Kraft are highly vulnerable to water scarcity and weather-related spikes in agricultural commodity prices, and its core insurance business is also facing higher payouts. A resolution filed in November by the advocacy group As You Sow accuses the company of “amplifying risk by continuing to invest in and underwrite high GHG-emitting activities,” and asks it to reduce its financed emissions in line with the Paris Agreement. But a similar measure last year failed, with only 44% of shareholders voting in favor. Buffett did not respond to a request for comment from Semafor.

Room for Disagreement

Apart from the government subsidy angle, BYD — now the world’s top EV maker — bucks the typical Berkshire investment profile. Buffett is “not big on newcomers,” he wrote in his letter, and is known to avoid companies that are very capital intensive — such as an automaker attempting to build a global EV empire from scratch. His investment in BYD speaks to the company’s early-mover advantage, and to his confidence in the long-term EV transition. But as the industry gets more crowded and China phases out its subsidies, Buffett may be getting cold feet: Last year Berkshire downsized its BYD holdings after Buffett confessed that “we don’t want to compete with [Tesla CEO] Elon [Musk.]”

The View From Shenzhen

BYD’s stock price jumped 4% on Monday after the company announced plans to expand both the highest and lowest ends of its offerings. It rolled out a new $230,000 luxury EV race car, and a $14,000 EV hatchback. Small, low-cost models are the company’s sweet spot, and the place it can apply maximum pressure on U.S. and European rivals that have struggled to come up with competing models. But they may be safe from competition on U.S. soil for now: In an interview this week, BYD’s executive vice president said “we don’t have plans to come to the U.S.”