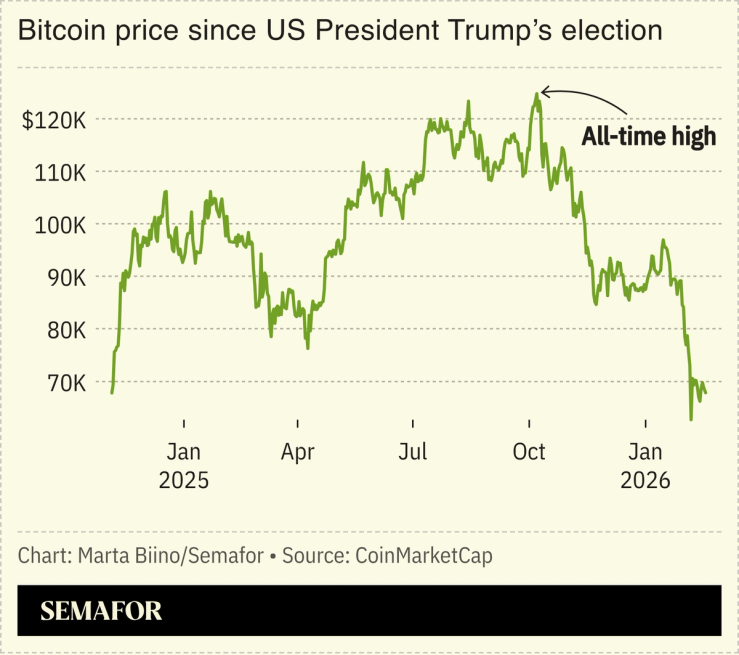

Bitcoin has lost its gains since crypto-friendly US President Donald Trump took office. The digital asset has slumped more than 40% from its October peak, notching its fourth straight weekly decline, with some analysts warning there is no bottom in sight. Standard Chartered slashed its 2026 price target for Bitcoin to $100,000 — it was once as high as $300,000 — warning it could fall to $50,000 this year. Investor Michael Burry, famous for betting against the US housing market, warned of a “death spiral” that could extend to company balance sheets exposed to the cryptocurrency.

It has been a gloomy month for digital assets, but there is a glimmer of hope in the UAE, where the underlying blockchain technology is gaining traction. A new report by Blockchain Center Abu Dhabi and crypto exchange Binance found that distributed ledgers now underpin national digital identity systems, about $4 billion in real estate tokenization plans, and a growing number of stablecoins used in payments and remittances.

International Holding Co. (IHC), First Abu Dhabi Bank, and Sirius International Holding recently won approval to launch a dirham-backed stablecoin that will run on an Abu Dhabi-developed blockchain. Units of the $240 billion conglomerate IHC, chaired by Sheikh Tahnoon bin Zayed, plan to embed the token across their operations, potentially reaching millions of users outside traditional financial systems.