US stocks and gold are on a historic run, and the top investment pick for 2026 is to buy more: That’s according to Manpreet Singh Gill, Standard Chartered’s chief investment officer for Africa, the Middle East, and Europe, who reiterated the bank’s call from last year, saying that both asset classes still have room to grow.

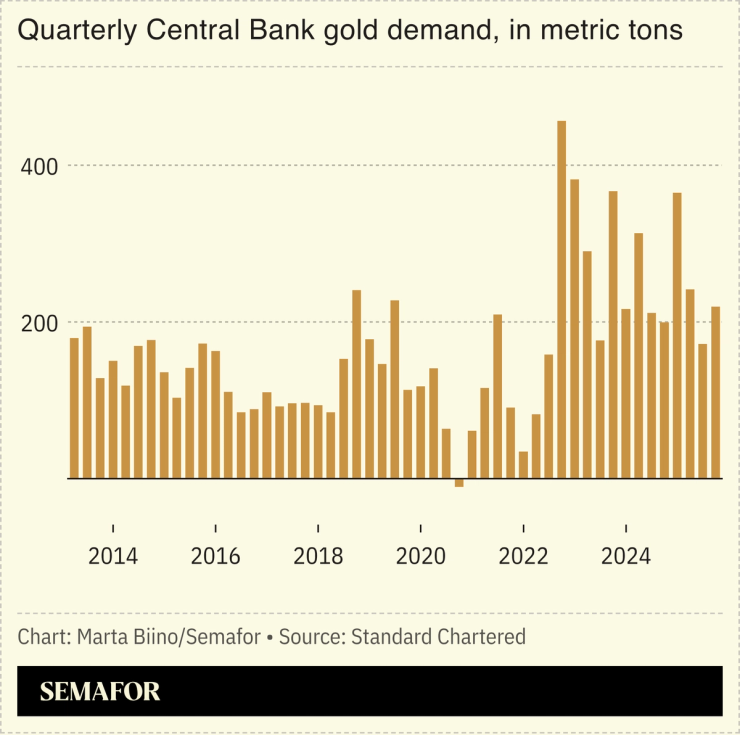

For US equities, the debate over an AI bubble is warranted, but the tech sector’s earnings growth, lower interest rates, and a weaker dollar can support further gains, Gill said at a briefing in Dubai. Gold surged more than 60% in 2025, a rise largely driven by demand from central banks seeking alternatives to US dollar holdings. Gill expects that trend to continue this year.

Standard Chartered isn’t advising investors to bet exclusively on the two assets — though that would have generated an impressive return in hindsight — and sees opportunities for regional diversification. India is worth looking at because it’s trading at a discount to its emerging-market peers, Gill said.