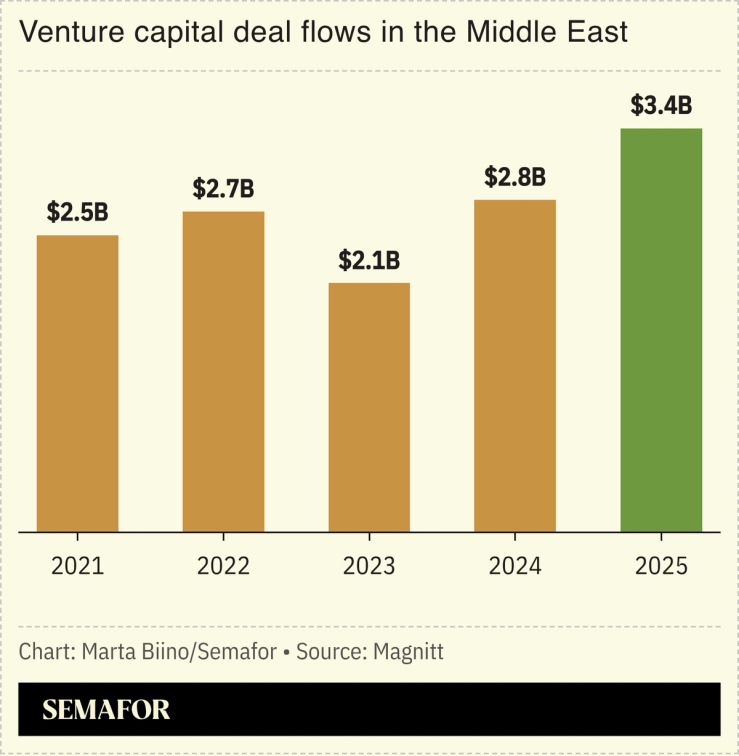

Venture capital deals in the Middle East jumped last year to an all-time high of $3.4 billion as more global funds dove in. The region bucked a wider slowdown in startup funding across other emerging markets, and is now almost the same size as the venture market in South East Asia, according to a report by data provider Magnitt.

Saudi Arabia was the biggest market for venture deals in the Middle East, with $1.7 billion of new funding rounds, followed by the UAE.

The figures are a reflection of increased government focus on promoting entrepreneurship as a way of creating jobs, as well as regional success in attracting international funds: Almost half of venture capital investments in the region last year came from global fund managers, a new record, with investors including Blackstone, General Atlantic, and Permira building up their investment activities in the Middle East. That’s a shift for the Gulf, which had in previous years been driven by local, often government-backed, funds.

This year will likely see more startups merging or acquiring rivals as a way of creating exit opportunities for investors, or looking to sell shares through initial public offerings, according to Magnitt.