The News

Saudi Arabia said it will open its stock market to all foreign investors on Feb. 1, as it looks to reverse last year’s lackluster performance and enhance the liquidity of a market it sees as key to financing its economic diversification.

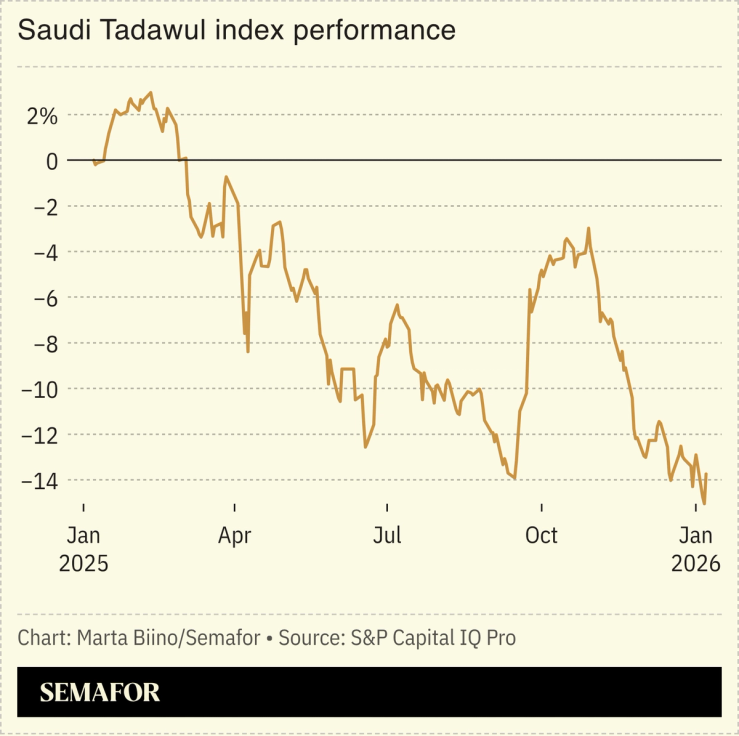

The announcement provided a boost to the Tadawul, as the Saudi market is known, driving it up as much as 2.5% on Wednesday before paring gains.

In this article:

Matthew’s view

The Tadawul’s success is not simply defined by daily fluctuations: Attracting foreign capital is critical for the government as it prepares to raise cash by selling stakes in state-controlled companies.

Investors have said in recent months that greater access, on its own, isn’t enough to overcome the fact that better returns are available elsewhere. Saudi Arabia first opened up its stock market in 2015, initially allowing large fund managers to buy local stocks, rules it will fully liberalize next month.

But most large fund managers are already able to buy into Saudi stocks — and the country has been part of the MSCI Emerging Market index since 2019 — which indicates that the latest steps are unlikely to trigger massive inflows. Indeed, international fund managers paused new allocations to Saudi equities late last year.

Traders are instead more focused on whether the regulator will follow through on a commitment to lift foreign ownership limits, currently capped at 49%. If that happens — as is expected this year — it would signal that the kingdom is serious about becoming a global capital market, and could unlock significant inflows.

Anything short of that risks disappointing investors who already have concerns about corporate earnings growth amid lower oil prices, government spending cuts, and uncertainty around investment in key economic diversification projects.

Those concerns are weighing on the outlook for share sales, which have become an important fundraising tool for the state. Over the past few years, the kingdom has been one of the most active markets for stock offerings, driven by sales of shares in the state oil giant Saudi Aramco and holdings of its sovereign wealth fund.

Notable

- “Saudi stocks remain rather unappealing,” one analyst told Bloomberg, after the Tadawul marked its worst year in a decade in 2025.

- “Fewer but better” IPOs are expected on Gulf stock exchanges in the year ahead, AGBI reported.