| | The next few weeks will test how green Wall Street is willing to be.͏ ͏ ͏ ͏ ͏ ͏ |

- Conciliation on Wall Street

- Oilfield collusion?

- Targeting uranium

- H2 gold rush

- EV insurance

New revelations about Big Oil’s climate dissembly. |

|

A climate reonciliation on Wall Street |

| |  | Tim McDonnell |

| |

Climate activists protest outside UBS's annual general meeting in Basel, Switzerland. Denis Balibouse/Reuters Climate activists protest outside UBS's annual general meeting in Basel, Switzerland. Denis Balibouse/ReutersWells Fargo shareholders rejected a proposal this week for the bank to report on whether its corporate lobbying conflicts with its net zero targets, following the rejection last week of other climate-related measures by shareholders of Bank of America and Goldman Sachs. But more notable than the loss at Wells Fargo were two votes at Citigroup that didn’t happen at all, and which could signal a new era of rapprochement on climate between banks and a broadening range of their investors. The anti-ESG backlash among Republican lawmakers in the US has created a perilous environment for the biggest asset managers, with State Street and several others backing out of a $68 trillion climate investment group for fear of being tarred as activists. For climate-minded investors, this week was a typical rough start to the corporate annual general meeting season that will stretch over the next month or so, which has become a forum for recurring battles between executives, asset managers, and activist investors over companies’ climate policies — usually with more losses than wins on climate-related votes. But in some corners of Wall Street, the activist investors who used to shout about climate from the sidelines are getting more sophisticated about finding common ground with companies and other shareholders. Over the next few weeks, shareholders will vote on a record 263 climate-related resolutions at North American companies, setting a test of how strong that coalition really is. |

|

| |  | Liz Hoffman |

| |

Daniel Kramer/Reuters Daniel Kramer/ReutersThe Federal Trade Commission plans to recommend a potential criminal case against the former CEO of Pioneer Natural Resources for comments he made to Texas rivals suggesting they coordinate ways to drill less oil, people familiar with the matter said. The FTC on Wednesday barred Scott Sheffield, who led Pioneer until the end of 2023 and orchestrated its pending merger with Exxon, from sitting on the combined company’s board as a condition of approving the deal. The agency doesn’t have criminal authority but is looking to refer the matter to the US Justice Department, the people said. In text messages obtained by the government, Sheffield discussed ways to curtail production and assured officials at OPEC+, the cartel of oil-producing countries that includes Saudi Arabia, Russia, and Venezuela, that Pioneer and its Texas rivals were trying to keep output artificially low. Shale producers competed themselves into financial ruin in the 2010s, spending billions of dollars to drill new wells and acquire acreage. Nobody is eager to do that again, and “capital discipline” has become the industry’s watchword. That’s why Exxon is buying Pioneer — and why Chevron is buying Hess, Diamondback is buying Endeavor, and Occidental is buying CrownRock, all since last September. The problem isn’t saying those things on earnings calls and in media interviews. It’s saying them to competitors and OPEC officials on WhatsApp, as the government alleges Sheffield did. |

|

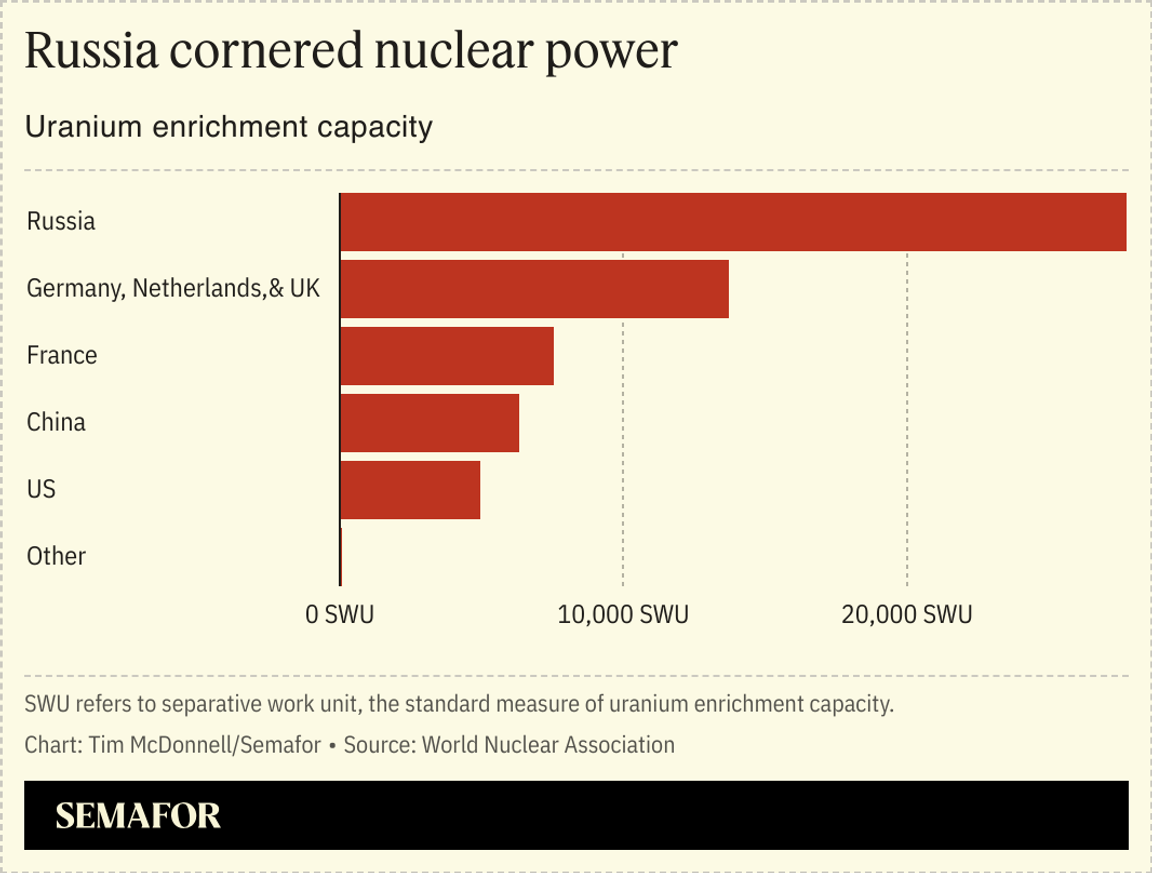

The US Senate approved a bill to ban imports of uranium fuel from Russia, dealing a blow to the Kremlin war machine and a win for US clean tech entrepreneurs.  Russia is the world’s top exporter of nuclear fuel, which has been left untouched by Western sanctions focused on Russia’s much more lucrative fossil fuel exports. So far, those sanctions have had mixed results, according to a study last week by Paul Saunders, a former Russia official in the George W. Bush administration. Russia has been able to redirect most of its oil, but restrictions on access to Western technology are impeding Russia’s ability to build out its Arctic drilling and LNG shipping industry, and gas exports are way down. If US President Joe Biden signs the uranium ban, as he is expected to do, Russia will struggle to find alternative buyers. Nuclear power plants in the US, meanwhile, are closely watching a boom in domestic uranium mining driven by the energy transition. |

|

Projected investment in green hydrogen production in Namibia over the next five years. Production is expected to begin this year on the country’s first commercial plant to convert renewable energy and water into a low-carbon fuel that will likely be in high demand to decarbonize heavy industry and transportation in Europe and the US. Namibia has plenty of two key ingredients for green hydrogen production: Unlimited sunshine and lots of space. But it is thousands of miles from its intended customers; the key to the industry’s long-term viability is to bring down shipping costs. |

|

| |  | Prashant Rao |

| |

Daniele Mascolo/File Photo/Reuters Daniele Mascolo/File Photo/ReutersElectric-vehicle buyers in the US and elsewhere may have access to a bevy of financial incentives and tax credits, but an increasing number are suffering sticker shock when it comes to paying for car insurance and repairs — and that’s unlikely to get better for several years, according to the founder of an EV-repair startup. New EVs can often have lower day-to-day running costs than their fossil fuel counterparts, but their weight, design, and complexity mean they are harder to repair and have unique and unexpected costs, thanks in part to a shortage of trained labor and often weak right-to-repair laws, Nikhil Naikal, the founder and CEO of Kinetic said in an interview. EVs have fewer mechanical parts which, in theory, should make them easier to fix. But their increased digitization means mechanics need new skills and specialized parts. Their precise design also means minor scrapes or bumps can be ruinously expensive to address. The vehicles are also heavier, resulting in increased wear on tires. And while manufacturers have churned out an array of new and differentiated models, they have not been as quick at issuing guidance on how to repair the vehicles. The results have been felt not just in the US — car insurance premiums have gone up 37% in the past four years — but around the world: UK premiums jumped 58% last year alone, while Australia is scrapping huge numbers of vehicles that have suffered relatively minor damage. “The baseline costs of owning an electric car are actually lower, at least initially,” Naikal said. “And then they start ramping.” |

|

New EnergyFossil Fuels- BP is pressing deeper into the Gulf of Mexico, placing its chips on territory that infamously set it back $60 billion after the Deepwater Horizon disaster. The company is trying to catch up to its much larger rivals like Shell and Exxon that are focused on farther-flung offshore drilling projects.

Mining & Minerals EVs |

|

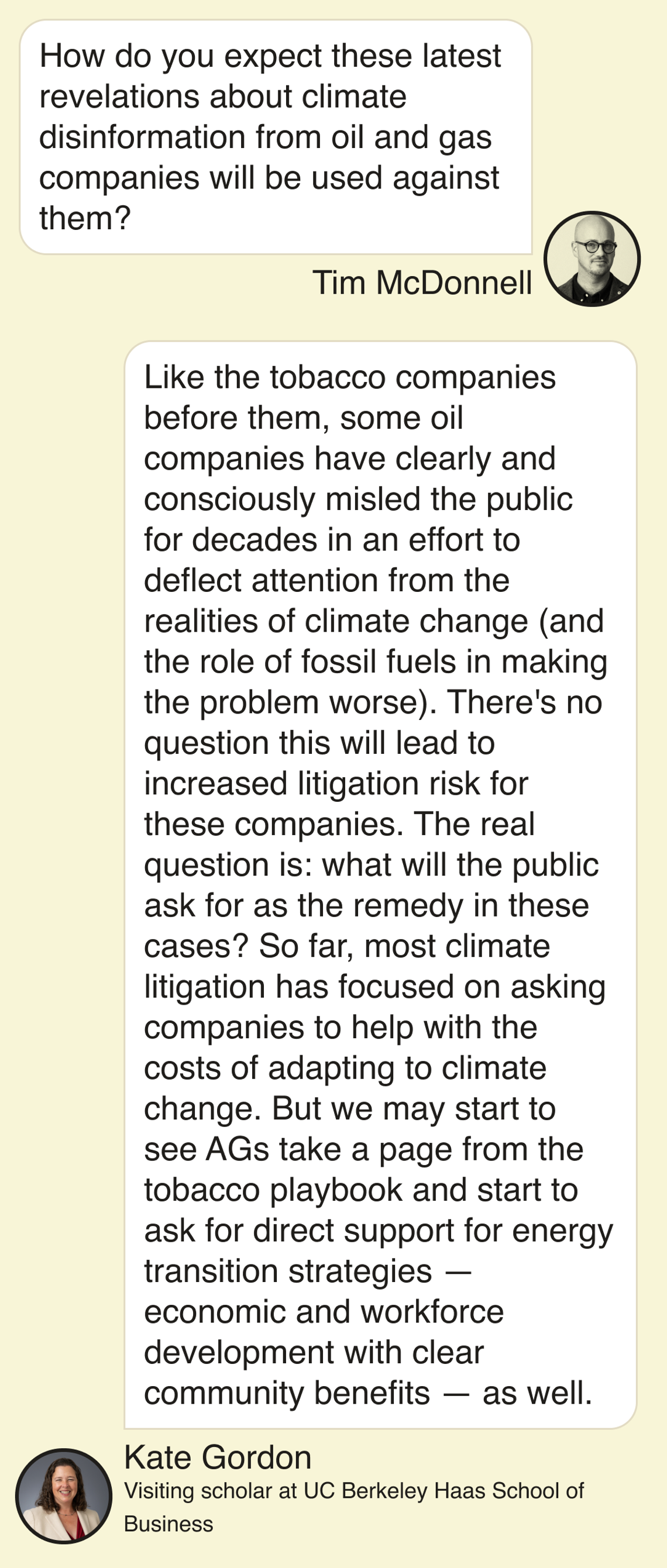

Kate Gordon, visiting scholar at UC Berkeley Haas School of Business. Congressional investigators released a new report this week documenting the extent to which oil companies have hid their awareness of the dangers of climate change.  |

|

| |