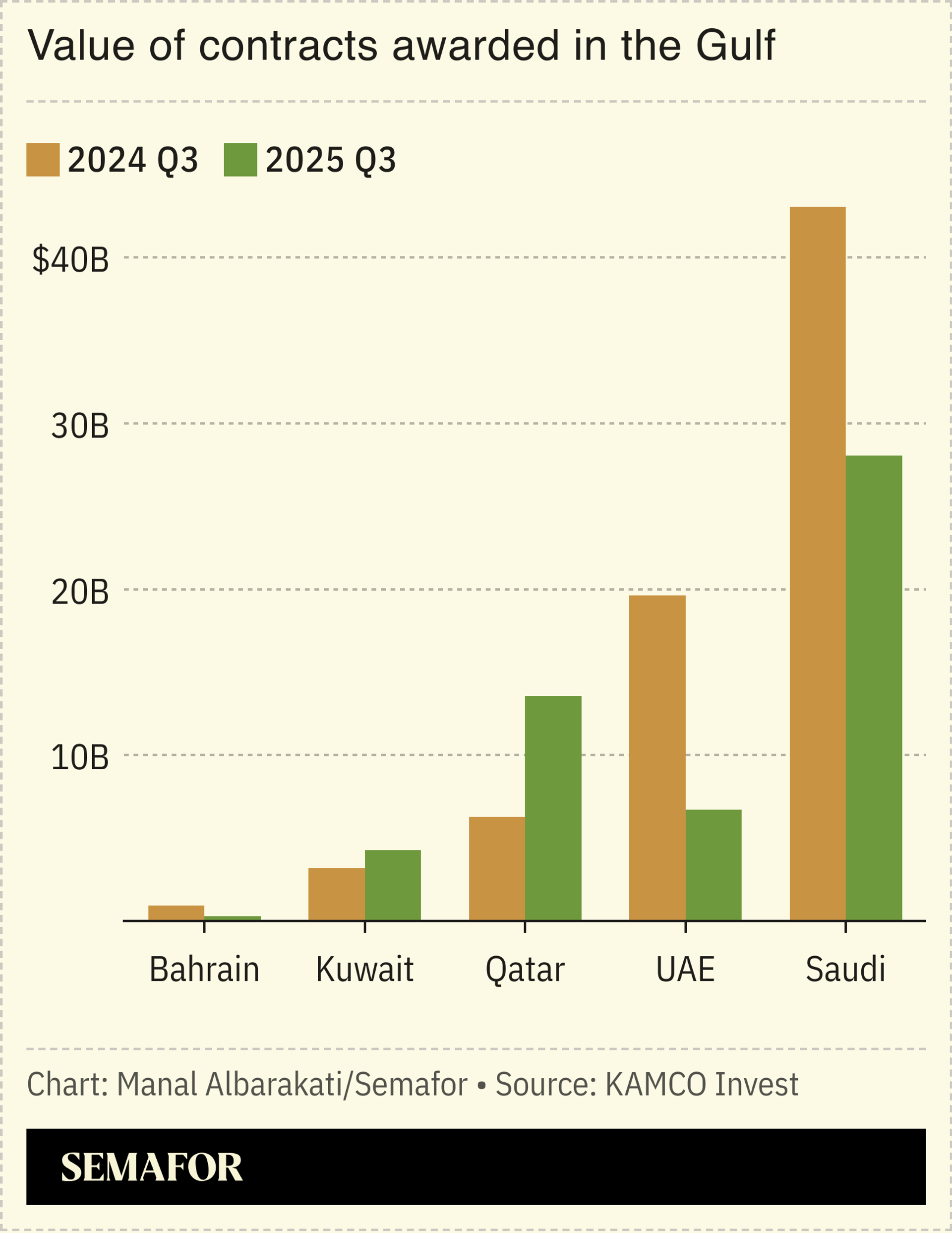

Gulf construction contract awards dropped 27% year-on-year in the third quarter to $54.8 billion, the second-lowest level in ten quarters, according to KAMCO Invest, a Kuwait-based asset manager.

The fall was led by Saudi Arabia, the region’s largest construction market, and the UAE. The region-wide decline follows two years of record spending on oil, gas, and infrastructure. Lower oil prices and spending reviews are weighing on Saudi projects. Public Investment Fund has cut budgets for some projects, including NEOM, as priorities shift toward building the infrastructure necessary for events like Expo 2030 in the capital and the 2034 men’s soccer World Cup.

Qatar and Kuwait were the outliers, with contract awards rising ahead of Qatar’s bid to host the 2030 Asian Games and Kuwait’s investment in new power and desalination projects.