The Scoop

Sam Bankman-Fried’s crypto hedge fund started losing money, in every way you could lose it, from the moment it had real money to lose.

After borrowing more than $100 million from two philanthropic comrades of Bankman-Fried in early 2018, as Semafor reported Wednesday, Alameda Research lost $20 million within a month. The figure appears in internal documents that blame poor internal controls, a lack of basic trading safeguards, and crippling interest payments.

The documents are a sort of post-mortem, compiled by Bankman-Fried in the spring of 2018 and shared with others, that tried to dissect and explain the problems that had already piled up. They show that the risky trading and lax oversight that eventually brought Alameda down — and with it Bankman-Fried’s FTX empire — were there from its earliest days. (Bankman-Fried is an investor in Semafor.)

Losses in February of that year ate through nearly all of the $15 million in profits that Alameda had racked up in its four months of existence, according to the documents, which say that the firm:

- Lost $2.5 million when it converted $110 million in cryptocurrency borrowed from Jaan Tallinn, the co-founder of Skype, into cash because it failed to properly hedge against it. The cryptocurrency in question, ether, fell while Alameda was offloading the stake.

- Misplaced $10 million worth of coins. Moving crypto between exchanges can sometimes require a manual final step, and Alameda missed it on some transactions. At the time, it “didn’t have systems that would notice a transfer that [never] arrived,” and by the time they realized and retrieved the coins, their value had dropped, racking up at least $3 million in losses.

- Lost $3 million betting against bitcoin and buying other tokens – a plain-vanilla trading strategy – because it didn’t bother managing spreads in the portfolio.

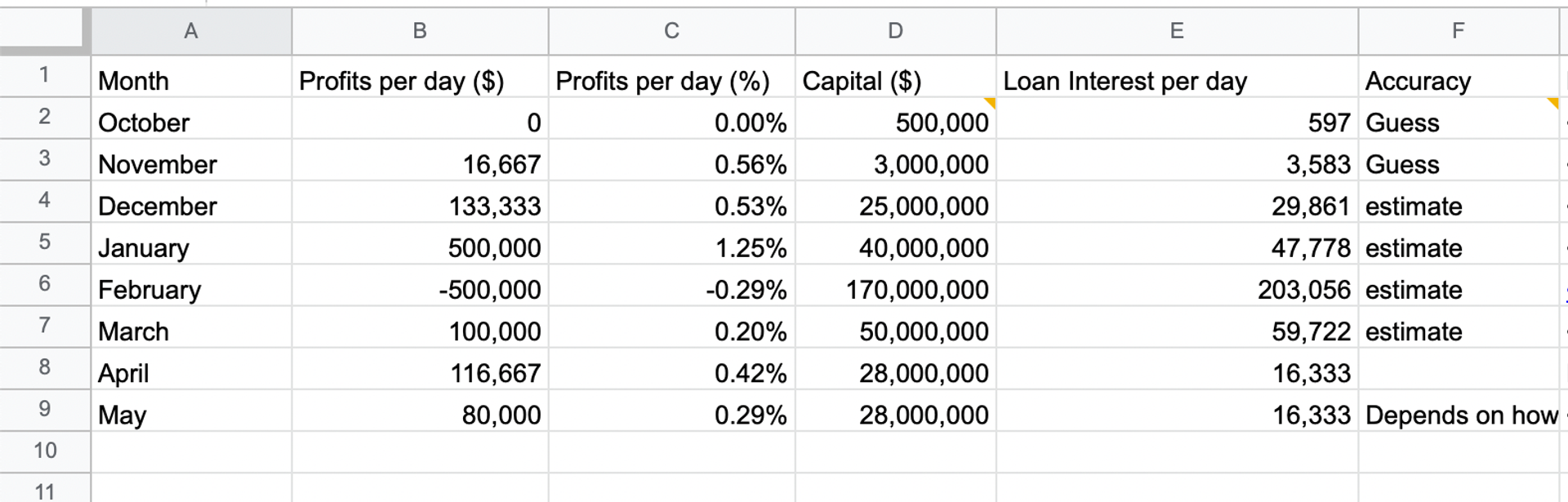

- Spent $9 million on interest payments to Tallinn and Luke Ding, a former currency trader turned philanthropist, whose loans charged 43%. “This was a small price to pay in an environment where it’s easy to make 1% per day,” Bankman-Fried wrote in one document, “but when our trading was poor the interest piled on.”

- Paid Tallinn a $2.2 million fee up front.

Alameda launched in the fall of 2017 with $500,000, the documents show, and profited by exploiting small differences in the price of cryptocurrencies in different countries. One spreadsheet shows the firm had estimated daily profits of about $17,000 in November and $133,000 by January.

That’s when Bankman-Fried raised serious money from Tallinn and $6 million from Ding. (We told the story of those loans, and the deep ties between Alameda and the Effective Altruism movement, yesterday. Read it here.)

Tallinn and Ding demanded their money back in March, and Alameda didn’t have the money to pay the interest that had accrued. It cut a deal, giving back about 80% of their money and reducing the interest rate on what remained of the loan, the documents show.