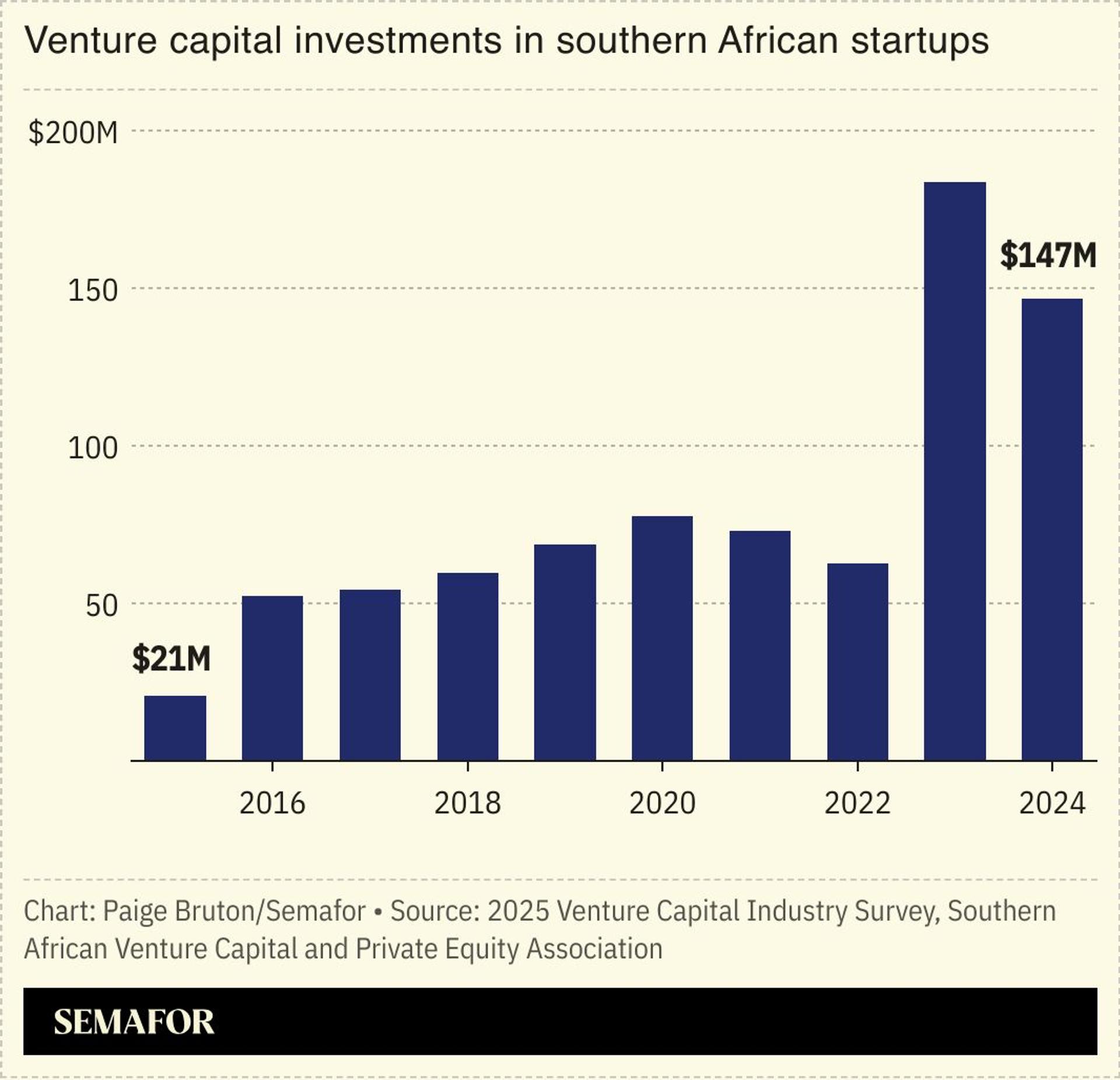

Around $180 million was invested in startups in southern Africa last year across a record 224 deals — a 17% year-on-year increase in deal volume.

A report by the Southern African Venture Capital and Private Equity Association showed the value of active investments in southern Africa’s venture capital space rose by a quarter, to about $745 million, though the size of equity deals fell by a fifth.

Technology companies — mainly software and fintech providers — accounted for two-thirds of total investments. And the health sector, led by medical services providers, was the next best, making up a fifth of the total.

More than half of all deals went to companies in South Africa’s Western Cape province while Gauteng, the country’s industrial hub, received 27%. The year marked the “lowest exit activity on record,” the report said.