The News

Ghana’s central bank held an emergency meeting last week without announcing a decision on its key lending rate, sparking uncertainty around monetary policy as the country recovers from its worst economic crisis in decades.

The tumult comes days ahead of the finance minister’s mid-year budget review on July 24 — a key moment for the new government that came to office in January, to present its vision for economic growth.

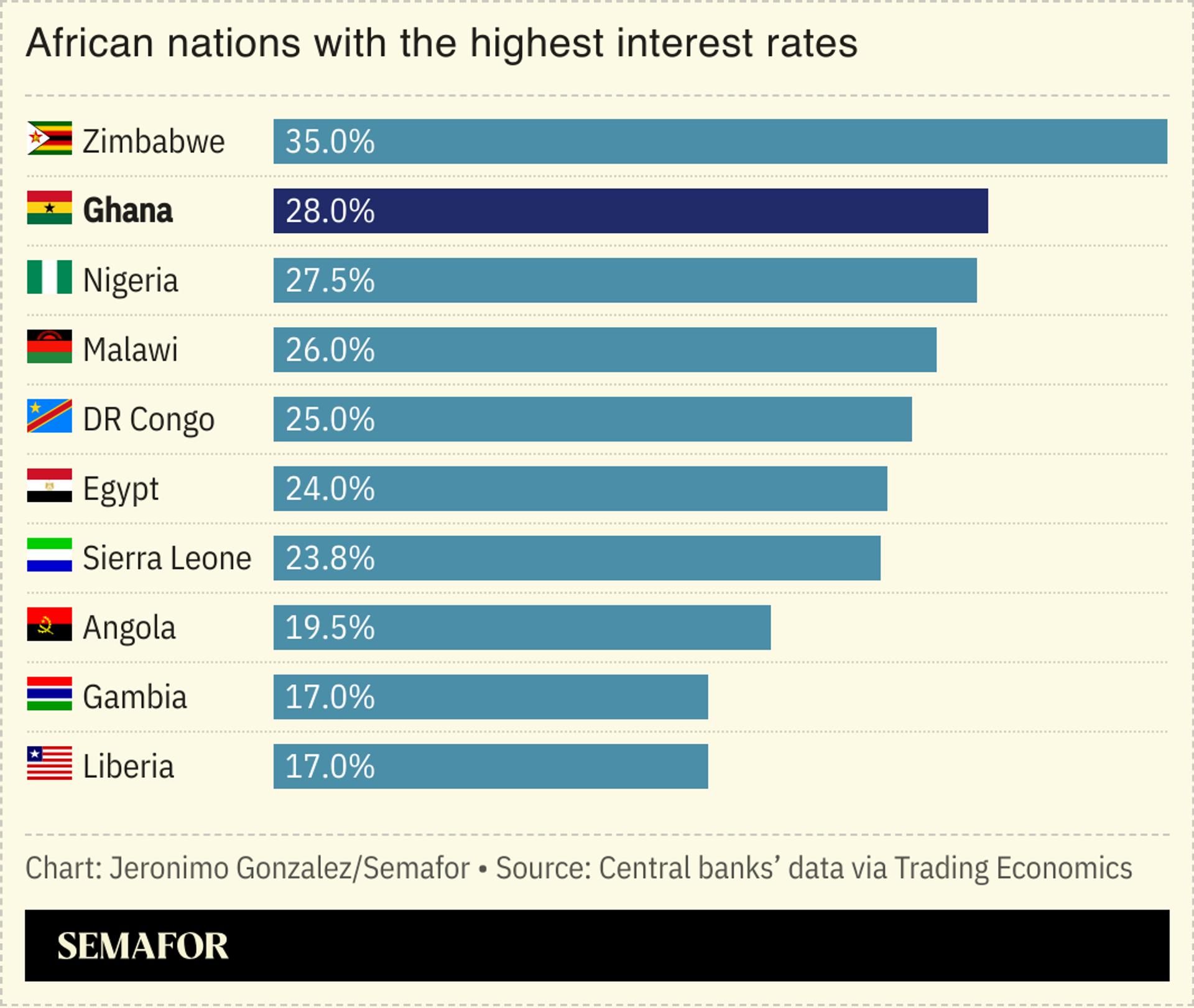

The Bank of Ghana held its benchmark lending rate at 28% at the monetary policy committee’s (MPC) last meeting in May. With exchange rate stability helping inflation to slow to 13.7% in June, its lowest level since 2021, some analysts expected the bank to start easing its policy stance to reduce borrowing costs and stimulate growth.

The bank convened its MPC on Thursday for what it described as an “emergency meeting” but canceled a planned press conference scheduled for Friday at which it was expected to announce its policy decision. The bank said its rate decision would be announced on July 30, following its regular MPC meeting.

Policymakers met to “review numbers and also take stock of some of the developments in the markets to get a sense of what is going on,” said Central Bank Governor Governor Johnson Asiama.

In this article:

Know More

The new government inherited a currency that was selling at above 15 cedis per dollar in December 2024 alongside an inflation rate of 23.5%. Despite losing 19% of its value against the US dollar in 2024, according to the Bank of Ghana, triggering inflation and reducing investor confidence, the cedi has strengthened to around 10 cedis to the dollar in recent months.

The bank, in a statement, said a broad range of macroeconomic indicators had improved. The cedi is up more than 40% against the dollar this year, which has helped the gold and cocoa producer to reduce its foreign debt and signaled an economic recovery.

Bright Simons, vice president at the Accra-based think tank IMANI, told Semafor a “gap” remained in the approach taken by the Bank of Ghana and the finance ministry, which meant monetary and fiscal policy do not complement each other. “The Bank of Ghana is still offering higher rates for its securities, which are thus competing with the government of Ghana securities, and suppressing demand,” he said, adding that some finance ministry officials felt the bank had held the benchmark interest rate “too high, for too long.”

Economists surveyed by Bloomberg ahead of last week’s MPC meeting predicted that the central bank would announce a steep interest rate cut from 28% to 25.5%. A reduction on that scale would be the largest in more than two decades, according to Bloomberg.

Step Back

The sense that Ghana’s economy is rebounding is, in part, based on the performance of the cedi and the belief that the exchange rate has stabilized after the disruption of recent years — the cedi lost around 50% of its value against the dollar in 2022. But reports of difficulties securing dollars at the official rate have raised questions about the economic realities faced by business amid suggestions that the currency is not as strong as officials claim, since dollars are not widely available at the official exchange rate.

A group of importers, in a statement last week, said banks are refusing to make dollars available at the official rate, forcing them to “resort to the black market for dollars at exorbitant rates.” They said they would pass the costs on to customers, if the problem persists, which would push up prices.

In the weeks preceding the importers’ statement, officials at five banks told Semafor they were not able to meet the dollar demand of their customers. Nana Poku, who heads the Traders Advocacy Group Ghana trade union, said dollars are available on the black market but the high cost would be passed on to customers. “We consider the BoG rate to be ‘artificial’,” he told Semafor.

Asiama, responding to the claims, said the cedi’s recent gains were not “cosmetic.”

The View From Washington

Ghana defaulted on most of its $30 billion sovereign debt in December 2022, which led to a $3 billion bailout by the International Monetary Fund and debt restructuring.

“The authorities have made significant strides toward rebuilding international reserves and taken steps to bring inflation down,” the IMF Executive Board wrote in its fourth review of Ghana’s extended credit facility, published this month. It went on: “The Bank of Ghana should maintain an appropriately tight monetary stance until inflation returns to its target, reduce its footprint in the foreign exchange market, and allow for greater exchange rate flexibility.”

Notable

- The mid-year budget address by Finance Minister Cassiel Ato Forson is expected to offer a detailed assessment of the economy “including updates on revenue generation, spending, debt servicing, and policy direction,” according to MyJoyOnline.