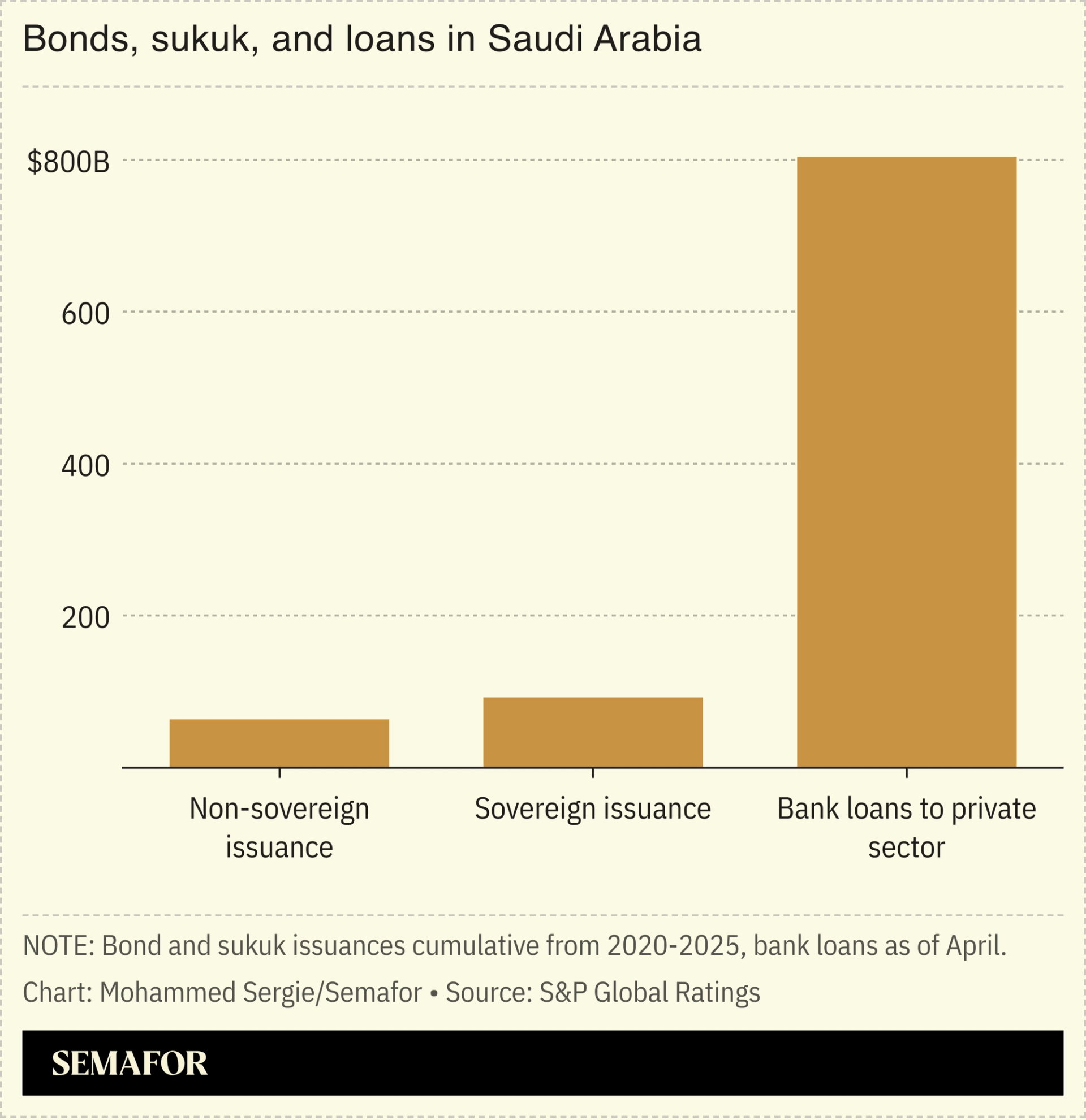

Saudi Arabia’s domestic bond market is growing, slowly, as both lenders and borrowers prioritize direct loans from banks over public issuances.

According to S&P Global Ratings, bonds and sukuk issuances remain small and concentrated among state-linked entities, with nonfinancial corporate issuers accounting for just 10% of the total.

The number of foreign investors and levels of secondary trading are limited, in part because of onerous regulations and poor market infrastructure: S&P identified changes and upgrades that could accelerate the development of a Saudi riyal-denominated bond market, which is a long-term aim of the kingdom in order to diversify funding and access long-term capital.

AD